What could upset the recovery? Political risk has been the biggest stumbling block to growth in recent years, but the election of Macron to the French presidency last Sunday has taken it off the radar for now. Italian politics still poses a threat, but our base case is for their election to be delayed until next year.

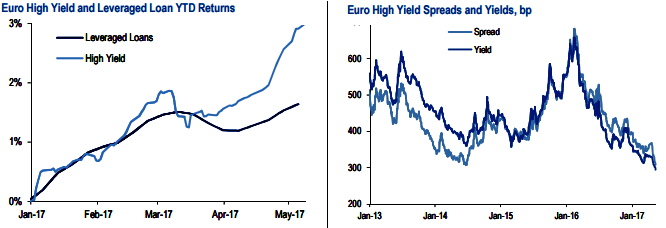

With French election tensions now having abated, yields are back in record territory at 2.95%, and spreads are back to cycle tights (refer above figure). What felt like an optimistic FY return forecast of 4% at the start of the year now looks woefully inadequate against the 3% already accrued-to-date (refer above figure).

Right now we struggle to see what could cause an abrupt shift in momentum for credit markets.

Default rates are low, volatility is suppressed, and the two major potential stumbling blocks we can point to in Europe – the end of QE and Italian elections – may not begin to affect spreads until later in the year.

We enter the French vote with a risk-on portfolio but also hold some cheap hedges against tail risks.

Our key risk-on trades are short 30Y Germany, 2s/5s & 7s/15s German steepeners, OW basket of 10Y France-Spain-Italy vs. Germany, OW 5Y Cyprus vs. Germany and OW 20Y Greece.

We see 10Y Bund at 30-40bp, 2Y Schatz as high as -70bp, 10Y France-Germany at 40-65bp and 10Y Italy-Germany 170-195bp in a risk-on scenario.

In a risk-off scenario, less likely, we see 10Y Bunds at 0-10bp, 2Y Schatz as low as -140bp, 10Y France-Germany up to 200bp and 10Y Italy-Germany up to 350bp. Keep Jun18/Sep18 and Dec17/Dec18 ECB OIS curve steepener.

Keep 1s/5s and 2s/10s weighted conditional bear steepener. Convexity trades: favor paying 10Y in the 5s/10s/30s 50:50 swap fly, keep 2s/5s/10s bear belly cheapener and short Jun19 in the Jun18/Jun19/Jun20 50:50 EURIBOR fly.

Hedge risk-off from French election by holding 1Y/Bobl weighted bull flattener. Turn neutral on swap spreads ahead of the French election.

Take profit in Bobl/Bund swap spread curve steepener and close Jun17 Schatz conditional bear widener.

Keep Sep17 FRA/OIS widener and receiving 2Yx2Y EURUSD cross currency basis as attractive convex hedges against French election risk.

Stay short Schatz gamma via OTM puts but close shorts in 1Yx2Y and Mar18 EURIBOR gamma.

Stay long Bund gamma via OTM calls and 3Mx10Y gamma. Exit Schatz/Bund vol curve steepener.

UK: Snap election announcement unlikely to impact gilt yields – we stay neutral duration despite rich valuations. Keep reds/greens SONIA curve steepener.

1) 1Yx1Y/15Y swap curve steepener and

2) Short belly 2s/5s/10s gilt fly (50:50). Stay long belly 10s/30s/50s gilt fly (50:50).

Keep 30Y swap spread narrowers. Keep bullish bias on 10Y gamma and 10Yx10Y vega.

Hold fronts/greens weighted bear steepeners and 5s/10s/30s bear belly cheapeners.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate