The Chinese February Caixin services PMI eased back in Jan to 53.1 from 53.4 in Dec. The Feb NBS Services PMI has already been released and indicated a drop from 53.5 to 53.2.

Since the inauguration on January 20, President Trump has strengthened his tone of criticism against Japan’s auto industry and JPY. On January 23rd, he mentioned that “(Japan does) things to us that make it impossible to sell cars in Japan”. Then, he suggested that the U.S. administration would impose very strong restriction on efforts to devalue currencies in bilateral trade agreements.

And again on January 31st, the President added that “they (China and Japan) play the money market, they play the devaluation market and we sit there like a bunch of dummies”. As a result, JPY appreciated 1.1% against USD and 0.8% in trade-weighted terms

Whereas AUD is stuck in between the combination of a more high conviction Fed cycle in 2017 and further RBA easing should see policy rate cross-over occur for the first time since the late 1990s.

This would leave minimal carry support for AUD, which is particularly important given its vulnerability to a turn in China’s momentum or adverse developments in global trade.

Technically, since the medium-major trend of AUDJPY cross has been struggling for the momentum in its consolidation phase of major downtrend at stiff resistance of 87.609 levels, we may see one more round of bearish rallies in the months to come. For more reading on technicals, please follow below web link:

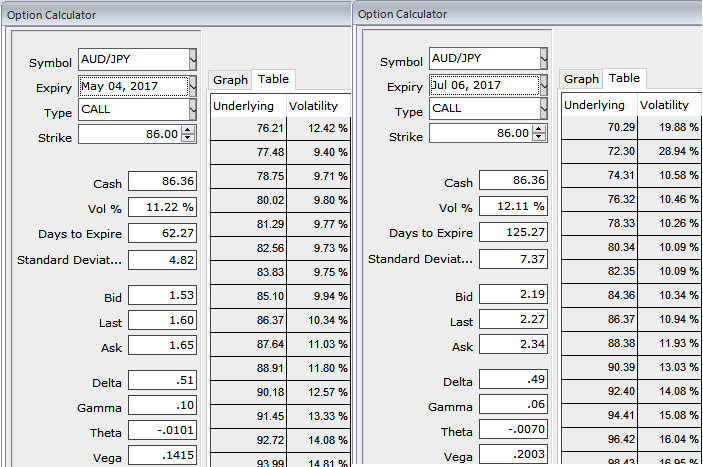

Please be noted that the implied vols of this underlying pair has trading at around 11.22% and 12.11% for 2m and 4m tenors.

As a result, we advocate below option trades in order to keep underlying FX exposures on check.

Accordingly, buy 4M and sell 2M AUDJPY OTM put (at strikes of 88.979 and 84 levels) in 1:0.753 notionals.

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action