OTC outlook and hedging strategy (EURAUD):

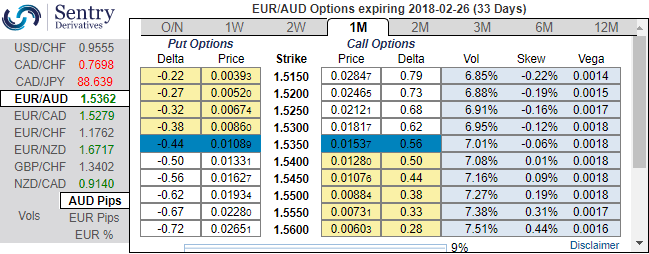

OTC Outlook and Options Strategy: In the case of optionality, the skews of 1m implied volatilities are projected to spike above the current realized, while the positively skewed IVs indicate bidding for hedging upside risks in the underlying spot (upto 1.56 levels).

Technically, the risk is essentially pricing in the bearish case in the short-medium trend but the major uptrend remains intact, as it is linked to the possibility of volatile Aussie spikes. We articulate the euro’s technical trend against the Aussie dollar in our recent post (refer the same in our technical analysis section).

Thus, contemplating all the above underlying factors of EURAUD, we like being short vol in short run, selling that premium conditionally on a pay-off benefiting from a lower spot.

At spot reference: 1.5353, prefer a ladder to a call spread ratio as we expect slumps to continue in short run and limited spot appreciation and topside volatility, accordingly buying a 1m call ladder are recommended. Buy 1 ITM Call of 1m tenor, simultaneously stay short in 2w 1 ATM Call and Sell 1 OTM Call of positive thetas (strikes 1.5225/spot/1.5435).

That structure improves the odds compared to a call spread ratio as the maximum and constant profit zone is reached over a range instead of a single spot level.

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing at -30 (which is bearish), while hourly AUD spot index was at -7 (neutral) while articulating (at 09:10 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different