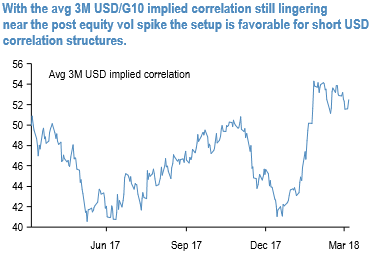

The lack of many reactions from the likes of Antipodeans and loonie fetches out prospects to buy underpriced hedges via optionality. Most noticeably, aggregate USD-denominated implied correlations still trade near their highs from around the VIX shock (refer 1st chart) – a set-up that is favorable for betting on the divergence between reserve and high beta currencies via short USD correlation structures.

1x2 forward volatility (FVA) spreads utilize favorable vol slide along term structures and are passage-of-time friendly, low maintenance long vega positions.

The basic construct involves selling a shorter dated FVA along the upward sloping segment of the vol curve to partially fund the purchase of a longer dated FVA along a flatter part of the term structure.

The roll-down of the short leg compensates (or even eliminates) the slide of the long position while preserving the overall net long vol exposure of the structure. Historically P/L on this type of structures closely coincided with bounces in the spread pricing (see 2nd chart).

In the case of EUR/Antipodean crosses, current entry levels near pre GFC lows are a bargain by historical standards(refer 3rd chart), while the net 6 months static vol slide at forward start of the short leg is substantially positive (+1vol), making the long/short structure superior to holding a similar expiry straddle.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes