FX OTC market has been reluctant for Swiss franc despite SNB’s monetary policy tomorrow.

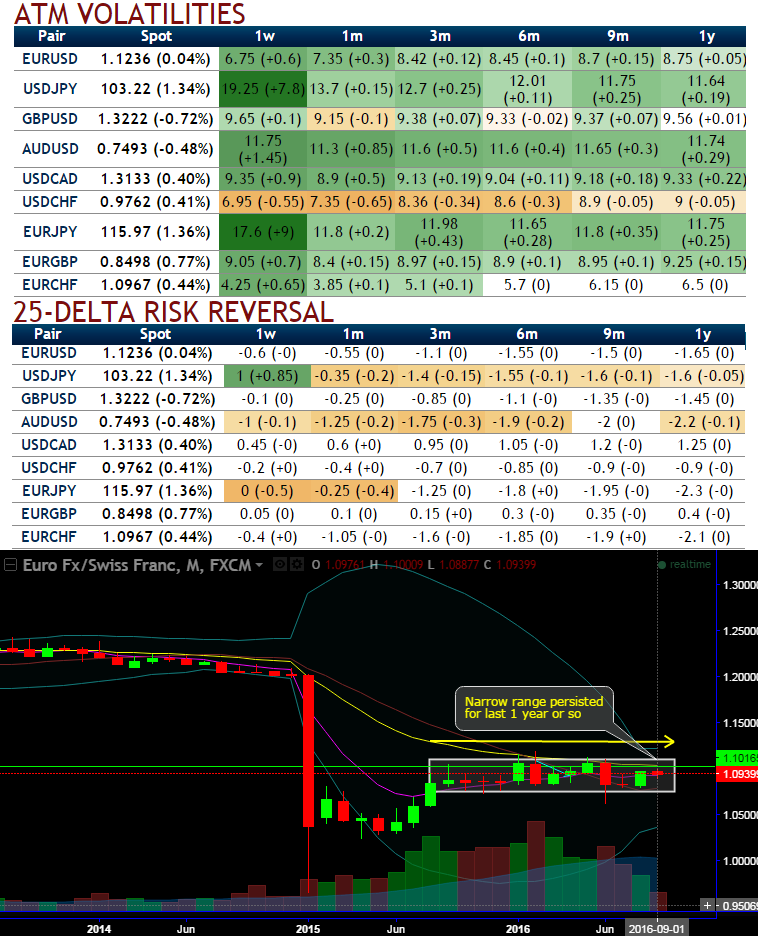

Please be informed that the implied volatilities of EURCHF ATM contracts of all expiries have been the least among G10 currency segment.

The Swiss central bank likely to maintain status quo in its monetary policy as the Brexit referendum and recent ECB action has not led to considerable pressure on the Swiss franc even if the foreign exchange interventions have continued with reserves increasing in August to CHF 626.6 billion.

While, the delta risk of reversal of the pair has also not been indicating any dramatic shoot up nor any slumps, but seems to be one of the pairs to be hedged for downside risks as it indicates puts have been relatively costlier.

Option-trade recommendations:

One can prefer iron condor on the lower IV circumstances. To execute the strategy, the options trader buys a lower strike OTM put, sells a middle strike ATM put, sells a middle strike at-the-money call and buys another higher strike OTM call. This results in a net credit to put on the trade.

Time frame: 7 to 10 days

Overview: Slightly bearish in the short term but sideways in the medium term.

Rationale: EURCHF’s range bound pattern is still persisting during lower IV situations but some bearish candles are indicating slight weakness on both weekly and monthly charts, (Ranging between upper strikes 1.1128 and lower strikes at around 1.0725 levels.

We could still foresee range bounded trend to persist in near future but little weakness on weekly charts is puzzling this pair to drag southward targets but very much within above stated range.

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings