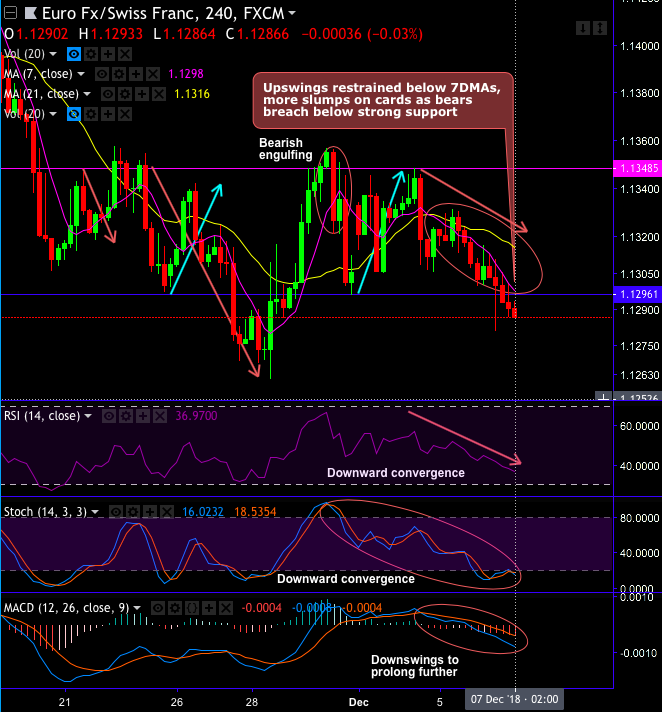

Technical Glance:EURCHFforms bearish engulfing pattern which has nudged price below DMAs. This bearish pattern has occurred at 1.1326 & 1.1344 levels on 4H plotting and 1.1522 levels that signals weakness in the major trend.

For now, more slumps seem to be on the cards upon bearish MACD & SMA crossovers (refer 4H chart).

While both leading oscillators (RSI and stochastic curves) show downward convergence to the prevailing price slumps that indicates the strength and bearish momentum in the selling sentiments.

The major trend that was in consolidation phase has now shown the failure swings at the stiff resistance of 1.1963.

The EURCHF exchange rate has already eased back below the 1.13 mark and has, therefore, returned into areas that are likely to begin causing the Swiss National Bank (SNB) discomfort.

Well, overall, on a broader perspective, the pair that was in the consolidation phase after a massive downtrend, bears have again managed to breach below major support zones – at 1.1375 (i.e. 21-EMAs) and 1.1297 (i.e. 7-SMAs), and now heading for retracing upto 50% Fibonacci levels (refer monthly plotting).

Trade Tips: Well, on trading perspective, at spot reference: 1.1285 levels, it is advisable to tunnel spreads using upper strikes at 1.1297 and lower strikes at 1.1260 levels, the strategy is likely to fetch leveraged yields with attractive risk-reward-ratio as long as the underlying spot FX keeps dipping below but remains above lower strikes on or before the expiration.

Alternatively, on hedging grounds, we advocate shorting futures contracts of mid-month tenors as the underlying spot FX likely to target southwards 1.1150 levels in the near run.

Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position.

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards -36 levels (which is neutral), while hourly CHF spot index was at 78 (bullish) while articulating (at 05:58 GMT). For more details on the index, please refer below weblink: