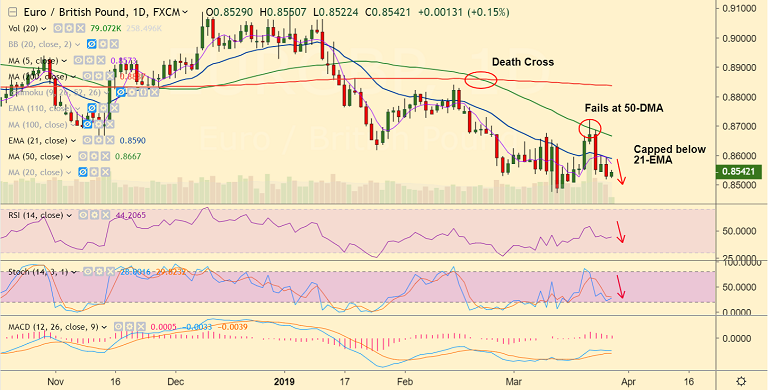

EUR/GBP chart - Trading View

- EUR/GBP is trading 0.13% higher on the day at 0.8540 at 1010 GMT.

- Upside in the pair lacks traction. Major trend in the pair remains bearish.

- 5-DMA is showing a turn southward. Upside on the daily charts is capped at 21-EMA.

- RSI and Stochs are biased lower and MACD supports weakness. Recovery was rejected at 50-DMA.

- 'Death Cross' formation (bearish 50-DMA crossover on 200-DMA) on the daily charts adds to the bearish bias.

- Scope for weakness till 0.8398 which is nearly converged 38.2% Fib and 200-W SMA.

- Break above 21-EMA will see upside till 50-DMA. Breakout at 50-DMA required for further upside.

Support levels - 0.85, 0.8417 (March lows till date), 0.8398 (nearly converged 38.2% Fib and 200-W SMA)

Resistance levels - 0.8572 (5-DMA), 0.8590 (21-EMA), 0.8666 (50-DMA), 0.8722 (Mar 21 high)

Recommendation: Stay short on upticks, SL: 0.8595, TP: 0.85/ 0.8420

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.