- EUR/NZD is extending its streak of gains for the 9th straight session, trades 0.25% higher on the day.

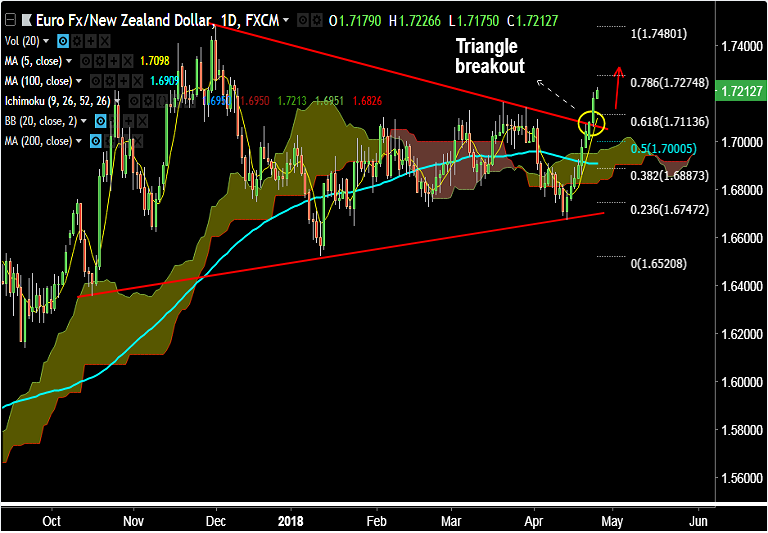

- The pair has shown breakout of 'Symmetric Triangle' pattern which has raised scope for further upside.

- Technical indicators are highly bullish and we see scope for test of 1.74 levels.

- Immediate resistance lies at 78.6% Fib at 1.7275, while immediate support is at 1.71 (5-DMA).

- Break below 5-DMA and retrace into 'Symmetric Triangle' could see downside till 100-DMA at 1.6909.

- Violation at 100-DMA negates bullish bias.

Support levels - 1.71 (5-DMA), 1.7065 (Triangle top), 1.70 (50% Fib)

Resistance levels - 1.7275 (78.6% Fib), 1.73, 1.74 (Nov 17 high), 1.7480 (Dec 1 high)

Call update: Our previous call (https://www.econotimes.com/FxWirePro-EUR-NZD-Trade-Idea-1254971) has hit all targets.

Recommendation: Good to go long on dips around 1.7210/20, SL: 1.71, TP: 1.7275/ 1.73/ 1.74

FxWirePro Currency Strength Index: FxWirePro's Hourly EUR Spot Index was at 6.88385(Neutral), while Hourly NZD Spot Index was at -55.0414 (Neutral) at 0600 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest.