As stated in our recent posts also we reiterate on medium term perspectives, Euro trading against dollar would see a high volatility amid Greece negotiations boiling around the corner.

EUR/USD needs a break above 1.1468 to open extended upside potential to 1.1700/1.810 and to eliminate the persistent sell-off risk.

EUR/Commodity FX proves to be surprisingly resilient, which suggests that the broader recovery is incomplete and could be resumed shortly.

Those who are expecting the pair to break the range 1.0521-1.2107, EUR gamma is worth owning heading into a critical weekend of Greek negotiations that could see capital controls unveiled.

Buy 1M EUR/USD straddles. Owning short-dated FVAs has been a durable source of vol alpha this year; Euro-bloc currencies (EUR, Scandis) currently screen as good 1M1M FVA buys.

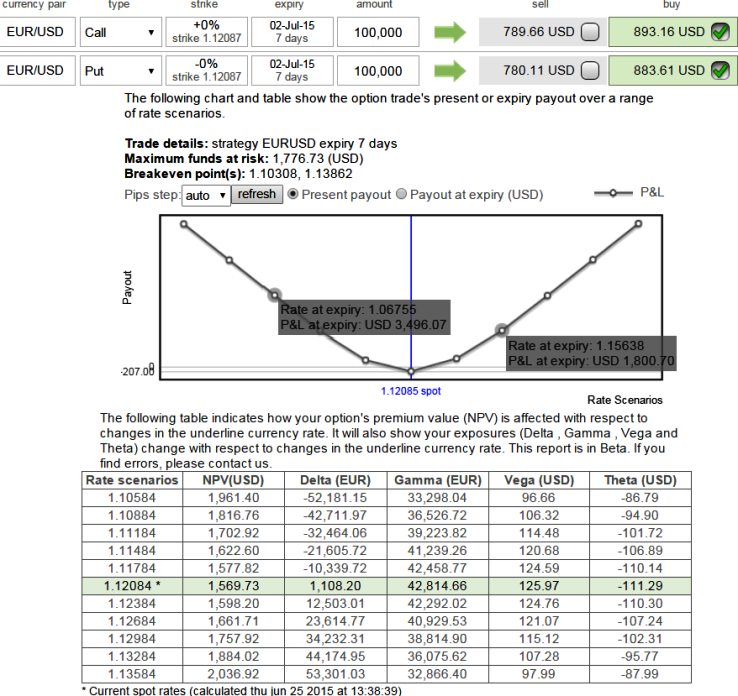

In order to execute this strategy one has to buy 1M At-The-Money call and buy 1M At-The-Money put options.

Option prices are more sensitive to move in the underlying FX when gamma is higher and increases the risk and reward for both option buyers and sellers.

As shown in the diagrammatic representation, gamma of the constructed position has been the largest which means larger risk/reward ratio due to the high sensitivity of delta with the underlying FX fluctuations.

Maximum Profit = Unlimited.

FxWirePro: EUR/USD gamma straddles worth buying on verge of lingering Greece turmoil

Thursday, June 25, 2015 8:27 AM UTC

Editor's Picks

- Market Data

Most Popular

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand