The Federal Open Market Committee increased the fed funds rate to a 0.50-0.75 percent range, as widely expected on later Wednesday. The statement noted that information received since the November meeting indicates that the labour market has continued to strengthen and that economic activity has been expanding at a moderate pace since mid-year.

Also, the new projections showed that the central bankers expect three quarter-point rate increases in 2017, up from the two seen in the previous forecasts in September, based on median estimates.

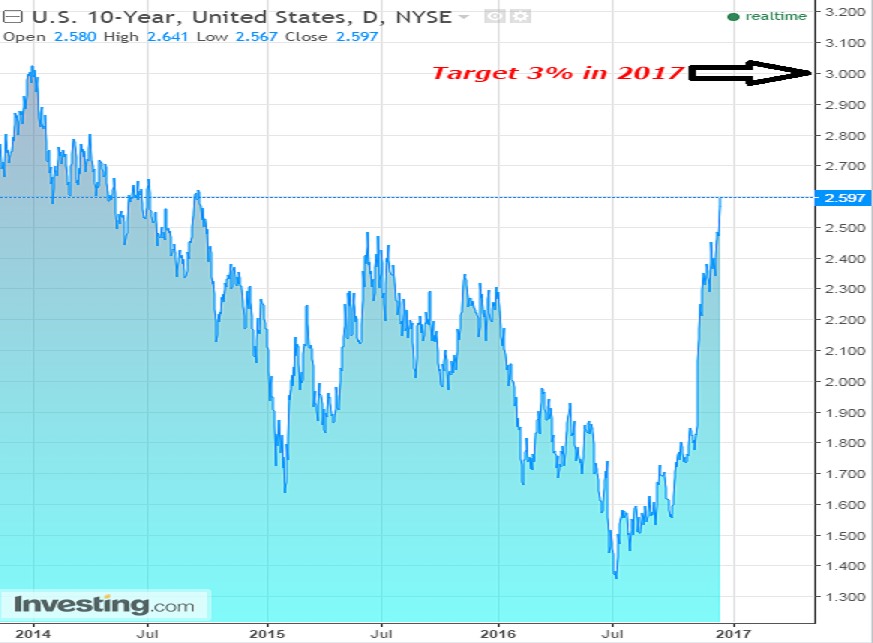

Following this news, the benchmark United States 10-year Treasury yields jumped 10 basis points to 2.62 percent, hitting highest since September 2014. Thereby, we foresee that next year the 10-year yields will likely break 3 percent mark, the highest level in three years.

Moreover, it is worth noting that the ongoing sell-off in U.S. Government bonds is mainly because of Donald Trump’s fiscal spending appeal, which is expected to be financed from government borrowing and not because of growth in U.S. economy.

If Trump successfully implements his fiscal plan, consumer inflation will surely rise, giving the Federal Reserve wider space for an interest rate hike. Thereby, rising Fed fund rate will increase the cost of borrowing. Also, increase in government debt will raise the risk of potential default. After the Presidential election result, Treasuries witnessed a massive sell-off, sending the 10-year yields higher by 80 basis points in just a month’s time.

Lastly, we expect that the inflation numbers will be the key determinants in the New Year to support the Federal Reserve hawkish path.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022