GBP/CHF chart on Trading View used for analysis

- GBP/CHF slumps over 1.40% on the day, trades at 1.2873 from session highs at 1.3094.

- Sharp sell off hitting the Sterling triggered by resignations in May’s Cabinet.

- Some members of PM May’s Cabinet resigned amidst a generalized opinion against the recently announced draft deal.

- UK Retail Sales came in below expectations for the month of October, further denting the pound.

- Data released earlier today showed UK retail sales contracted at a monthly 0.5% and expanding 2.2% YoY. Core sales dropped 0.4% m/m and rose at an annualized 2.7%.

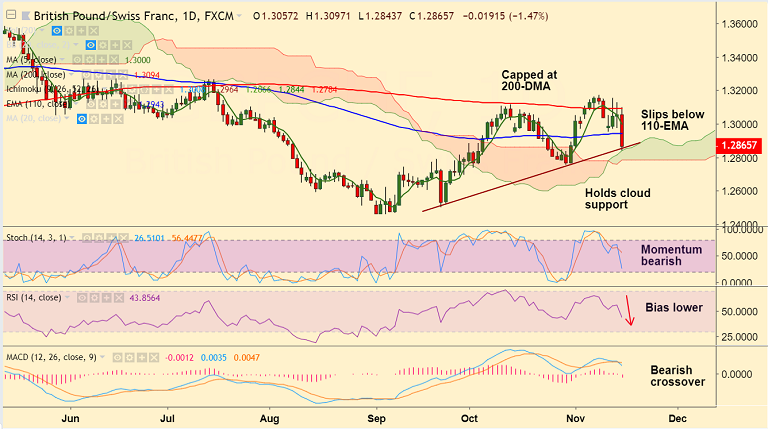

- Technical indicators on intraday charts have turned bearish. Stochs and RSI are sharply lower. MACD shows bearish crossover.

- The pair has slipped below 110-EMA and is currently holding cloud support. Break below daily cloud will accentuate weakness.

- Any bearish invalidation only on decisive breakout above 200-DMA.

Support levels - 1.2844 (converged cloud top and trendline), 1.2755 (Oct 30 low)

Resistance levels - 1.2944 (110-EMA), 1.3094 (200-DMA)

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data