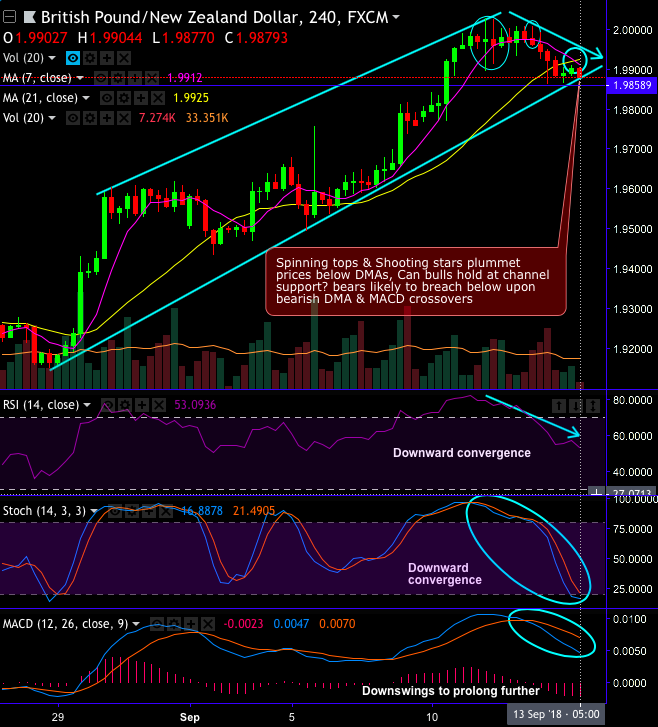

GBPNZD forms back-to-back spinning tops at 1.9973 and 1.9959 levels, shooting stars at 1.9960 levels. These bearish patterns plummet the prices below DMAs.

On the flips side, after the pair testing strong support at rising channel baseline (to be precise at 1.9865 levels), bulls have been attempting to bounce back at this juncture but without convincing volumes. As a result, trend seems to be weaker (refer daily chart). Can bulls hold onto the channel support, is the slightly baffling. While the bears seem to be most likely to breach below upon bearish DMA & MACD crossovers

Momentum study: Both leading oscillators (RSI & stochastic curves) show downward convergence to the prevailing price slumps that signal the strength and intensified bearish momentum in the downtrend.

Trend study: Bearish sentiments are backed by lagging indicators, 7DMA has crossed below 21DMA which is bearish crossover. While MACD also show bearish crossover that indicates ongoing downswings likely to prolong further on daily terms.

On a broader perspective, the major trend has been drifting in sideway from last 10-11 months, it has been sensing consolidation phase and lagging indicators substantiate this standpoint (refer monthly chart). Well on this timeframe, ongoing bullish swings likely to extend further above 21EMAs, momentum oscillators are popping up some overbought pressures.

Ahead of central banks’ monetary policy seasons in both the UK and New Zealand (BoE is scheduled for today and RBNZ on September 26th), FX markets are likely sense huge turbulence, and with accordingly we advocate below speculative binary option strategy.

Well, contemplating above technical reasoning, we could foresee equal chances for both bears and bulls with strong support at channel base and next at 1.9858 levels.

Hence, trading boundary strikes is desirable for traders who reckon the price of an underlying asset would restrain between these price bands for some time, but who are unsure of the direction. Use upper strikes at 1.9902 and lower strikes at 1.9858 levels, as long as the underlying spot remains between these two strikes, yields are exponential than the underlying spot. For cash or nothing, these options would be exercised if the forward prices to remain between both strikes (i.e. 1.9902 > Fwd price > 1.9858).

Currency Strength Index: FxWirePro's hourly NZD spot index is inching towards 35 levels (which is mildly bullish), GBP at -10 (neutral), while articulating (at 06:15 GMT). For more details on the index, please refer below weblink: