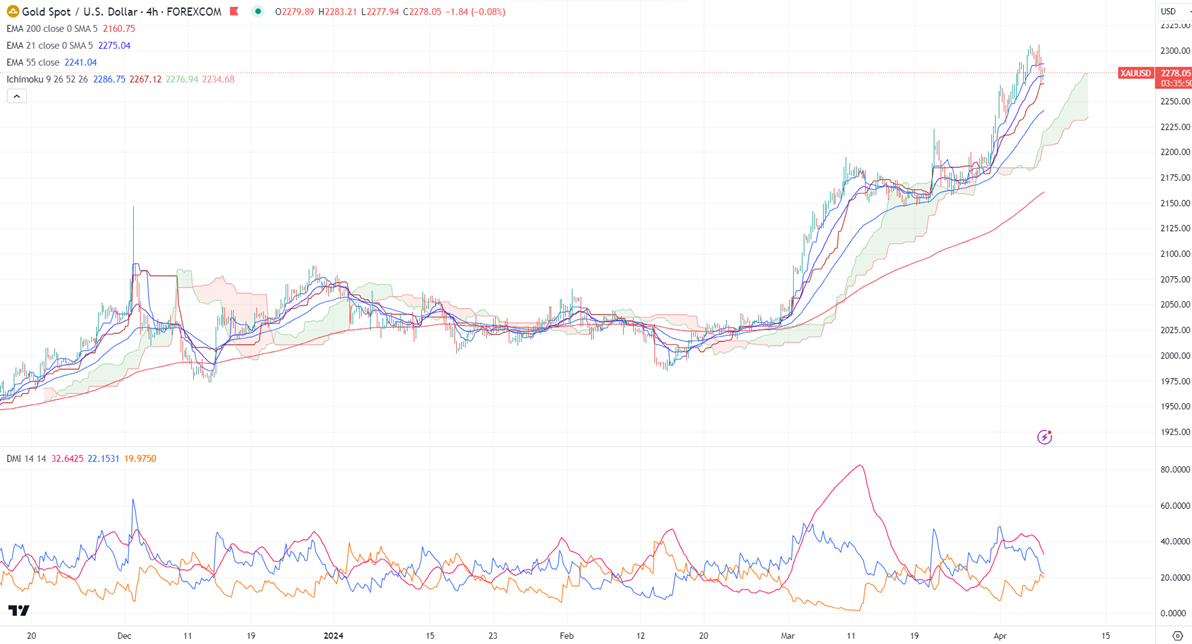

Ichimoku Analysis (4 Hour chart)

Tenken-Sen- $2286.75

Kijun-Sen- $2267.12

Gold pared some of its gains ahead of the US Nonfarm payroll. The yellow metal hit a low of $2267 yesterday and is currently trading around $2279.

The US economy is expected to add 213000 jobs in Mar from 275000 jobs the previous month. While the unemployment rate fell to 3.8% from 3.9% in Feb.

US economic data-

US Initial jobless claims- Positive (Bullish for Gold)

According to the CME Fed watch tool, the probability of a 25 bpbs rate cut in June decreased to 65.4% from 55.20% a week ago.

US dollar index- Bullish. Minor support around 104.65/104. The near-term resistance is 105.20/106.

Factors to watch for gold price action-

Global stock market- Bullish (negative for gold)

US dollar index - Bullish (Bearish for gold)

US10-year bond yield- Bullish (negative for gold)

Technical:

The near–term support is around $2265, a break below targets of $2250/$2228. The yellow metal faces minor resistance around $2305 and a breach above will take it to the next level of $2325/$2340.

It is good to buy on dips around $2250 with SL around $2228 for TP of $2300/$2325.

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed