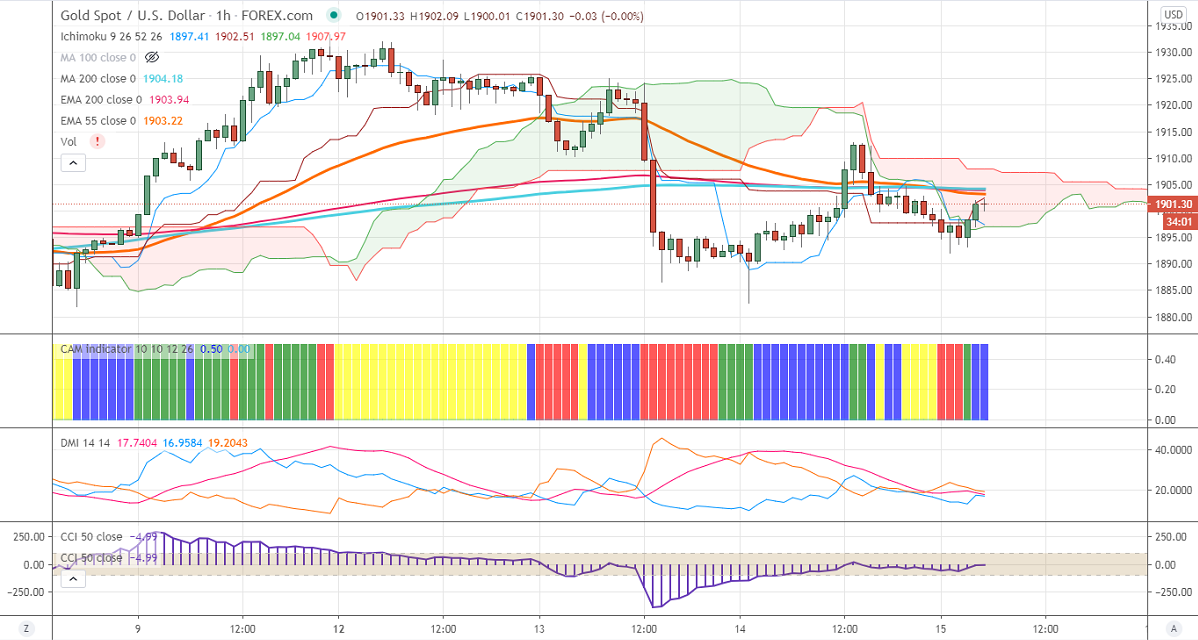

Ichimoku analysis (1- Hour chart)

Tenken-Sen- $1898

Kijun-Sen- $1901.50

Gold continues to trade in a narrow range between $1933 and $1882 for the past three days. The hopes of fresh stimulus from the US are putting pressure on Safe-haven assets like gold. DXY has halted its two days of the bullish trend. Any break below 93.25 will drag the index down till 93/92.50.

Economic data:

The annual US producer price rose to 1.2% in September compared to a forecast of 0.9%. The PPI for final demand came at 0.4% in September vs 0.3% in August. Markets eye US Philly fed manufacturing index and Initial jobless claims for further direction.

Technical:

In the Hourly chart, Gold is trading slightly below the long-term moving average (200- MA) and Kijun-Sen. Any break above $1904 (200- MA) will take the pair till $1910/$1920. On the flip side, near term intraday support is around $1880 and any indicative break below that level will take the pair till $1860/$1848.

It is good to buy on dips around $1895-96 with SL around $1880 for the TP of $1920/$1933.