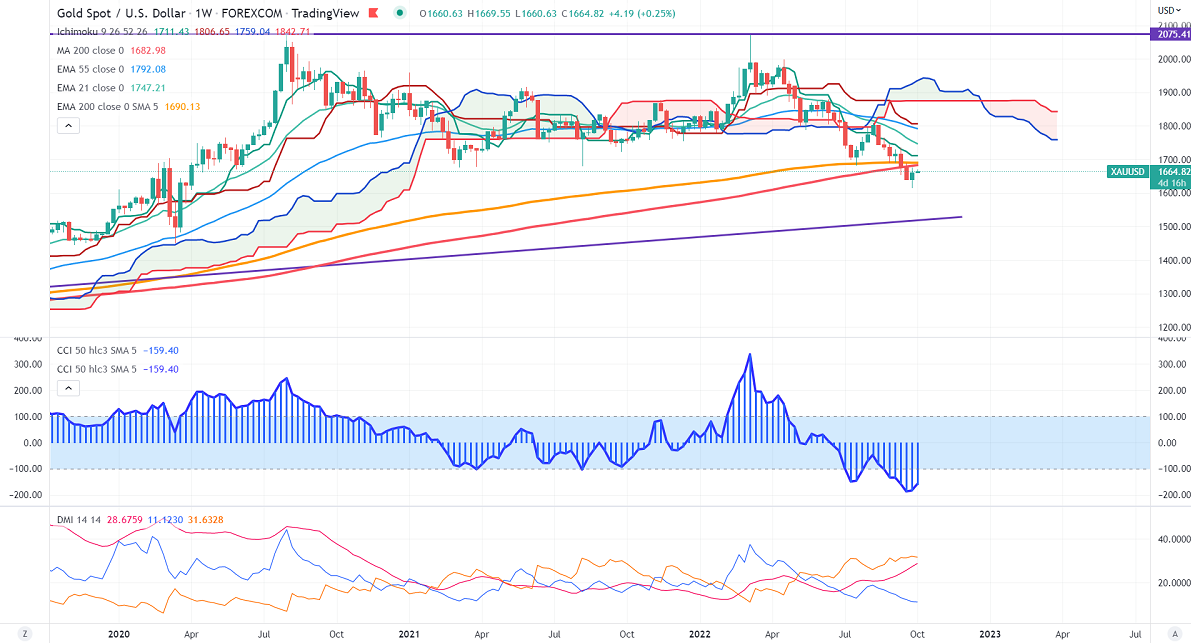

Ichimoku Analysis (Weekly Chart)

Tenken-Sen- $1711.43

Kijun-Sen- $1806.65

Gold recovered from its multi-year low on risk-off sentiment. The yellow metal was one the worst performer in the previous month and lost nearly $100 on the strong US dollar. The DXY gained sharply after the 75 bpbs rate hike by Fed. It hit a multi-year high at 114.77 and retreated from there.

US 10-year yield lost more than 8% after hitting 4.019%, the highest level in 12 years. The US 10 and 2-year spread narrowed to -41 basis points from -58% bpbs.

US core PCE inflation rose to 4.9% yearly, up 0.6% MoM. The number of people who have filed for unemployment benefits dropped by 16000 to 193000 the previous week, the lowest level in five months.

According to the CME Fed watch tool, the probability of a 75 bpbs rate hike in Nov declined to 53% from 72.5% a week ago.

Factors to watch for gold price action-

Global stock market- Bearish (positive for gold)

US dollar index – Bearish (positive for gold)

US10-year bond yield- Bullish (negative for gold)

Technical:

The near–term support is around $1640, a close below targets $1620/$1598/$1580.The yellow metal faces minor resistance around $1670, the breach above will take it to the next level of $1680/$1700/$1720. Minor bullish continuation only if it breaks $1740.

It is good to buy on dips around $1630 with SL around $1620 for TP of $1700.