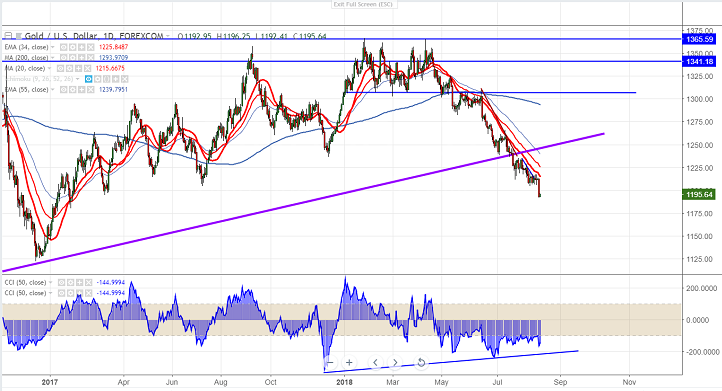

Overall trend - bearish

Gold has lost more than $20 from the yesterday’s high of $1213.71.The main reason for sharp fall in yellow metal was due to huge surge in US dollar index. DXY hits 13 month high yesterday at 96.52 and shown a minor decline from that level.The yellow metal has broken major psychological support at $1200 and declined till $1190.It is currently trading around $1194.96.

The major three factors to be watched for gold price movement are

- US Dollar index – bullish (negative for gold)- DXY has shown a jump of more than 150 pips in previous week and shown a minor dip of 20 pips from the high . It is currently trading around 96.31.

- USD/JPY- slightly bullish (negative for gold)- It has recovered slightly after hitting low of 110.11. It is currently trading around 110.86 (0.14% higher).

- US 10 –year yield – 2.89% (shown a jump of more than 1.5% from the low of 2.84%) It is slightly negative for gold.

- US 2 year yield 2.63% (0.47% higher). The spread between 2 year and 10 year yield (2.89%-2.63%) is 26 bass point slightly reduced from 35 basis point.

The pair is facing strong support at $1190 and any break below will take the yellow metal till $1178/$1160.

The near term resistance is around $1200 and any convincing break above will take the yellow metal till $1210 (10- day MA)/$1217 (20- day MA).

It is good to sell on rallies around $1200-02 with SL around $1210 for the TP of $1178.