General business situation – Business confidence strengthened in the September quarter to the highest level since early 2014. This improvement was well-founded, with September quarter GDP showing that quarterly growth accelerated to 1.1%.

Economic conditions remained favorable through the end of the year, buoyed by strong population growth, the recovery in dairy prices and booming construction and tourism sectors. This should see the survey’s activity indicators remain at solid levels.

We’ll be watching the survey’s measures of costs and prices closely to see whether inflation pressures are starting to build. Evidence so far has been limited, with firms’ pricing intentions falling last quarter, despite cost pressures edging up and firms reporting increasing difficulty in finding labor.

The currency is lagging the move in rate differentials, and

Chinese growth is anticipated to slower even in H1 2017 and ongoing RMB depreciation. While New Zealand remains highly exposed to a slowdown in Chinese demand, and the RBNZ won’t stay neutral in front of revived currency strength. Short rates already point toward a much lower NZDUSD.

Fading Chinese growth and commodity prices remain a major risk for commodity currencies. More specifically, China remains the second destination for NZ exports, just after Australia and before the US. Hence, any slowdown in Chinese demand will weigh on NZ growth and reduce the inflows, therefore weighing on the currency. We expect NZDUSD to fall to 0.64 by end-2017.

OTC Outlook and Hedging Strategy:

The NZD is projected to drop the most against the USD in 2017 and so does against JPY but moderately, NZDUSD reaching 0.64 by year-end. Downside medium-term kiwi volatility is expensive, suggesting RKO puts. Buy NZDUSD 1y put strike 0.68 RKO 0.59 for 0.98% (spot ref: 0.6997), which compares with 3.85% for the vanilla.

In NZDJPY, if you're a skeptic on ongoing rallies to have a restricted upside potential and expects abrupt declines then the below strategy is advisable.

Ideally, this is an option trading strategy that is constructed by holding underlying spot FX while simultaneously, buying the protective put and shorting calls against that holding.

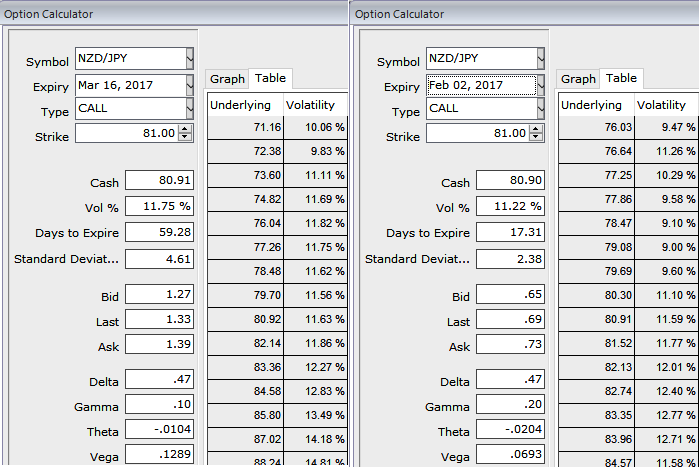

Please be noted that the 2w IVs are trading at around 11.22%, while 2m IVs are around 11.75%.

Well, the strategy goes this way: while you're holding longs in spot FX of NZDJPY, go short in 2W (1.5%) OTM striking call and long in 2m (1%) OTM striking put. Since the short term bullish sentiments are mounting we kept upside bracket little on the higher side.

This strategy is the best suitable if you're writing covered calls to earn premiums but wish to protect himself from an unexpected sharp drop in the price of the underlying security.

This serves as an economical strategy to deploy if you are writing covered calls to earn premiums but wish to protect yourself from an unexpected sharp drop in the price of the underlying spot.eco

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate