The Kiwi is expected to lose its pole position in terms of offering the highest central bank policy rate in G10 next year, and this should keep the currency a laggard. Moribund milk powder prices should also continue to drag on the currency.

NZD has been one of the poorly performing G10 currency against USD in 2017. A combination of weaker-than-expected economic growth, tighter funding conditions, slowing net immigration and a change of government all conspired to relegate NZD to wooden spoon territory last year.

We don’t think many of these factors will be too different in throughout 2018, as a result, we could still foresee scope for underperformance from NZD in the year ahead.

As we foresee that NZDJPY to breach recent ranges to the downside in 1H’18 and forecast the currency at JPY 74.500 by mid-2018. From there, it is reckoned that the currency should settle at USD 72.427 levels by the year-end.

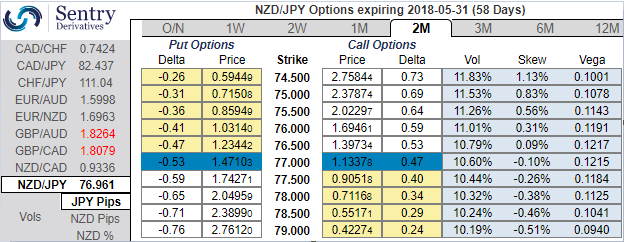

ATM IVs of NZDJPY is trending above 10.30% for 2m tenors and positively skewed IVs of these tenors are evidencing bearish hedging interests. Bids for OTM puts upto 74.50 is noticeable to signify the downside risks which is almost in line with our above-stated projections.

Accordingly, conservative hedgers can prefer the below strategy:

Debit Put Spread: as shown in the above diagram, one can initiate longs in 2M ATM -0.49 delta Put + Short 2m (1%) OTM Put with lower Strike Price with net delta should be at -0.16. Please be noted that the positive payoff structure would be generated as it keeps dipping below current levels but remain within OT strikes.

For a net debit, bear put spread reduces the cost of trade by the premium collected (on the shorts of OTM put) and keeps option trader to participate in downward moves and any upswings in abrupt.

Moreover, the risk is capped to the extent of initial premium paid, as opposed to unlimited risk when short selling the underlying outright.

However, put options have a limited lifespan. If the underlying FX price does not move below the strike price before the option expiration date, the put option will expire worthless.

Currency Strength Index: FxWirePro's hourly NZD spot index is inching towards 127 levels (which is bullish), while hourly JPY spot index was at 107 (bullish) while articulating (at 11:31 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures