USD/NOK is a better short for higher oil prices than USD/CAD:

Better growth and the possibility of monetary policy divergence... The Canadian economy is struggling in the aftermath of the shale-oil boom’s end.

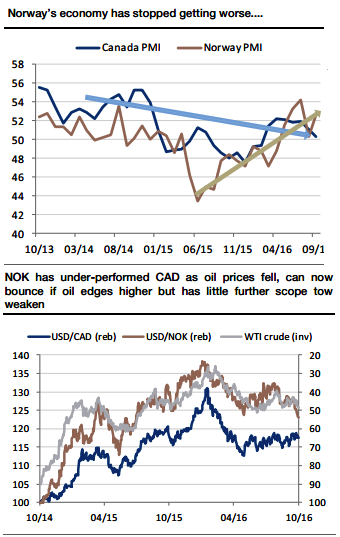

The manufacturing PMI has been falling for 6 months and employment growth has slowed to 0.6% per annum. Rates are low 50bp) but are likely to remain anchored even if the Fed hikes in December.

By contrast, the Norwegian economy is stabilising. The PMI is picking up and even if unemployment continues to trend higher, a shift away from falling investment in the petroleum sector to a pick-up in exports and a tailwind from the housing is helping the 2017 outlook.

This leaves the NOK better placed than the CAD to benefit from any further recovery in the price of oil and opens up the medium to longer-term, possibility of monetary policy divergence pushing CAD/NOK a fair bit lower.

Stay short in CADNOK at 6.0661 with the stop at 6.2259 (2.56%) and targets at 5.6 (7.68%) The carry almost exactly zero on forwards between 1-month and 1-year.

Risk-reversals were positively skewed by have fallen sharply, and volatility has picked up from summer lows, which makes a simple spot trade more appealing now than an option trade.

Risks: the only risks associated with above trade recommendation is that EURUSD slumps. There is a good long-term, correlation between CAD/EUR and EUR/USD where a falling EURUSD sees CAD out-perform NOK but in the last year, with more currencies rangebound, the r-squared on this correlation is just 0.05, so we worry about CAD outperformance only if we see EURUSD break below 1.06.

Is a Trump victory in the Presidential election partly priced in to USDCAD? It clearly is partly priced in to USDMXN, but the positive impact on CAD of a Clinton win is likely to be small.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings