Initiating shorts in GBPNOK seems less attractive ahead of the Conservative party conference on the growing indications that the government would seek to prioritize migration in its negotiations with the EU and so deliver an economically ‘harder’ Brexit.

The conference confirmed the political imperative to deliver migration control and so set in motion an accelerated sell-off in GBP which culminated with a 10% flash crash last Thursday.

While the startling price action says a lot about the impaired market microstructure in FX, it also speaks to the essentially one-way nature of GBP flow and is consistent with the risk that we have long highlighted of capital repatriation from the UK (the sense that investors are selling UK assets is reinforced by the pronounced shift in the correlation between Gilts and GBP).

We reckon that sterling would prolong to undershoot in the months to come but be firm it’s prudent to recognize strategic returns on the GBPNOK spot trade, partly because NOK has become a slightly crowed position, and partly because there is a risk of even more guppy price action in GBP over the next week or two resulting from the current legal challenge to the government’s prerogative to invoke Article 50 without the explicit approval of Parliament.

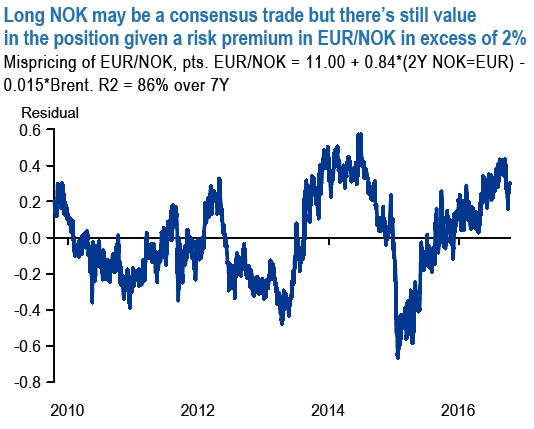

The High Court could rule on this next week - should it find against the government and in favour of the plaintiffs GBP could well bounce by 3-4%. There could also be a much smaller relief rally if the case is passed to the Supreme Court to rule upon. As for NOK, we remain structurally bullish even if tactically cautious and note that there is still a decent risk premium in EUR/NOK (fair-value is currently close to 8.75 – observe above chart).

Initiate shorts in EURNOK from 8.9850, for targets of 8.8969 with strict stop loss of 9.0085, thereby, one can achieve decent risk reward ratio.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary