A glimpse on Eurobond yields: 10year European real yields are down at -0.8% and have little scope to fall further, which in turn limits EUR/USD downside to what can be caused by a rise in US real yields. They are at 10bp currently, and look to have settled into a fairly tight range since April (10-30bp). That would appear to doom the EUR/USD to a tight range until talk of Fed tightening gathers momentum again (if it ever does). We look for some modest widening in the real rate spread in late 2016 and through 2017, which can take the EUR/USD into the bottom half of this year’s range. And we see a risk that the UK leaving the EU would trigger a sharper move down for the euro.

It’s been expected sell off in rates in H2 to help 30-50y spread dis-invert.

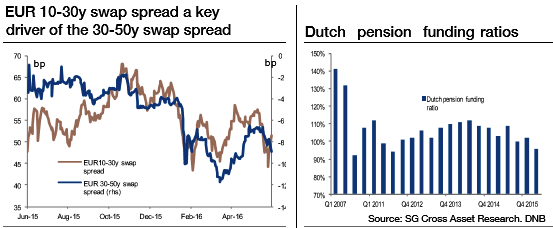

The main drivers of the 30-50y slope are the 10-30y slope (see graph), the 2y10y swaption vol (higher convexity of the 50y tenor relative to the 30y is more valuable when vol is higher, resulting in a flatter 30-50y slope), while the impact of V2X has diminished somewhat.

In a Brexit scenario where the EUR10-30y swap curve flattens to 30bp, 2y10Y normalised vol rises to 80bp annualised and V2X rises to 55 (2011 peak), the fair value of the 30-50y swap spread falls to -12bp, not taking into account mitigating risk of strong receiving of 30y swaps from Dutch pension funds given low current funding ratios.

On a six-month horizon, assuming rates sell off mildly and credit spreads tighten somewhat (more here), the 30-50y EUR slope would be expected to move back progressively toward zero.

The considerable risks would be a collapse in risk assets along with greater market illiquidity; this would lead to distortions in the ultra-long end of the swap curve.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary