Sell a put against existing cash short in EURSEK. Stay short NZDSEK in options The structural case for SEK appreciation remains intact the real effective exchange rate is 10-11% below its long term average despite an economy that has a positive output gap and which continues to deliver above-trend growth. This week it was reported that Q4’16 GDP jumped by 4.2%.

In addition we upgraded our forecast for Q1’17 from 3.0% to 4.0% (the Riksbank expects 3.2%). The problem for SEK is not the economy but rather monetary policy which is still myopically fixated on delivering at-target core inflation.

A central plank of the central bank’s strategy is too impede a fundamentally justified appreciation in SEK for as long as it can, which is why we expect only a relatively slow pace of SEK appreciation. In order to better reflect the outlook for a slow grind higher in SEK we are converting our cash short in EURSEK into a covered put.

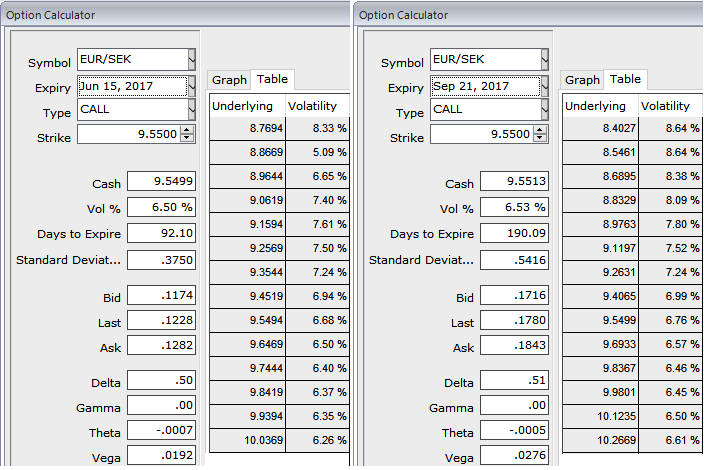

This serves to improve our entry level by around 0.5% and provides some positive time decay as SEK is prone to consolidate in the four weeks between the only data point that matters for Riksbank, CPI. EURSEK vols like all euro pairs are elevated as result of the French election premium so there’s added value in selling lower-strikes in EURSEK at this juncture. 3-mo implied vol of 6.65% compares to realized vol of only 4.9%.

Sell a 3-mo EURSEK put, strike 9.35. Receive 0.52%. Spot reference 9.5533.

Sold EURSEK at 9.4847 on January 13. Stop at 9.6850. Marked at -0.54%.

Bought a 6-mo NZD put/SEK call, strike 6.10 for 1.47%. Spot reference 6.2372. Marked at 0.42%.

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes