Last week, the trade protectionism theme shot back into focus as a potential major left tail risk for markets which got further aggravated by the subsequent retaliatory rhetoric from Europe and Asia.

President Trump has followed through on his promise to impose tariffs on steel and aluminum imports but alleviated the worst of the retaliation fears by excluding Canada and Mexico and leaving the door open for other US trade partners to be given similar exemptions.

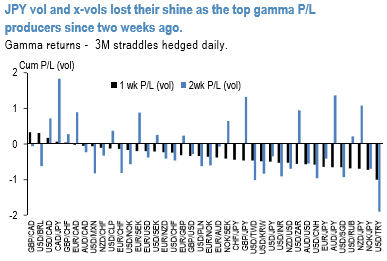

With risk on-risk off flip-flopping throughout the week gamma returns under delivered (refer above chart).Yet, residual risk remains of broadening tariffs, reprisals from trade partners and a disruptive finding of the China/intellectual property Section 301 probe.

JPY somewhat underperformed with USD amid firm risk sentiments until early February, and then turned to outperformer, triggered by a plunge in global stocks. On net, as the latter was more dominant, JPY became the outperformer within the G10 camp during the relevant period.

FX forecasts for all G10 majors were upgraded vs. USD intra-month. EUR/USD year-end put at 1.29 (prior 1.23). USD/JPY year-end at 108 (prior 112). On a tactical basis, we have reduced USD shorts, are still long euro, and have become long CHF and JPY as hedges.

In our model portfolio, we already carry long cross-JPY Vega in spread format (GBPJPY – USDJPY, BRLJPY – USDBRL), long EURUSD and EUR-cross (EURCAD) vol exposure and are short high dollar correlations (NZD vs. JPY) that should mean-revert lower if trade skirmishes intensify.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary