WTI was down 64 cents, or 1.34%, subsequently, as the major oil minors have come into a consensus to curtail inventory output faded.

Technically, USDCAD clears 1.2950 resistances with a break to two-week high; with bullish momentum indicated by the leading oscillators.

Watch out for more bullish potential upon break out above resistances of 1.3145.

It appears to be the CAD taking a halt from its intermediary bull run against USD (see both daily and monthly plotting).

As the declining crude price began weighing on demand for the commodity-related Canadian dollar as hopes of a production freeze began to fade and above technical indications, we encourage longs in USDCAD.

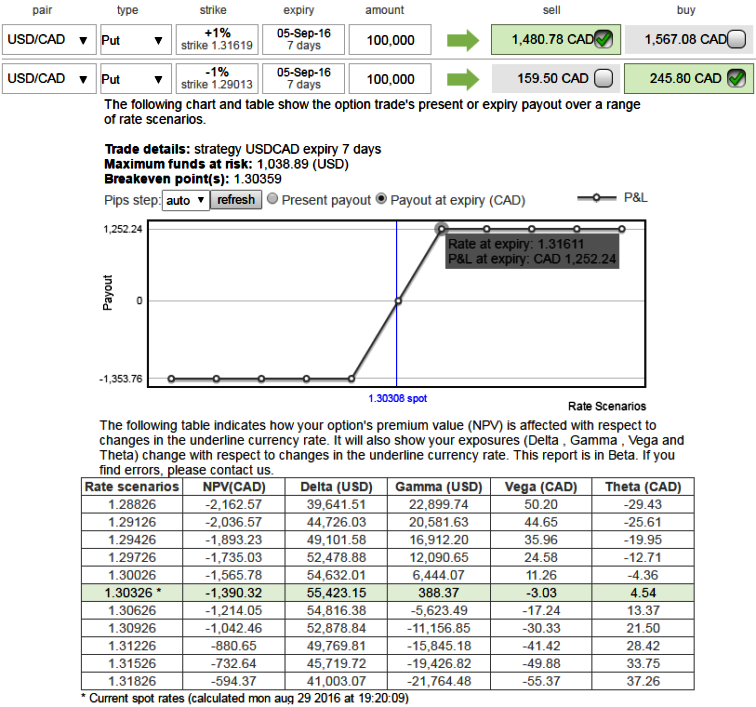

On speculative grounds for delivery purpose, we recommend buying rallies, and decide to initiate a bull put spread for net credits, so short 1W (-1%) in the money vega put with positive theta if you expect that USDCAD will spike up moderately over the next near future but certainly not beyond your imagination, simultaneously, go long in (1%) out of the money put option with 50% deltas.

Please be noted that the put you buy has to be OTM and the put you short has to be ITM with an anticipation of USDCAD could rise and remain unchanged within shorter expiration, and there onwards any fall below current spot FX would be taken care by longs in ATM put and also if you have any active longs in spot FX would be protected.

As shown in the diagram, one can enter into the above positions at net credit with the net delta of 0.55.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?