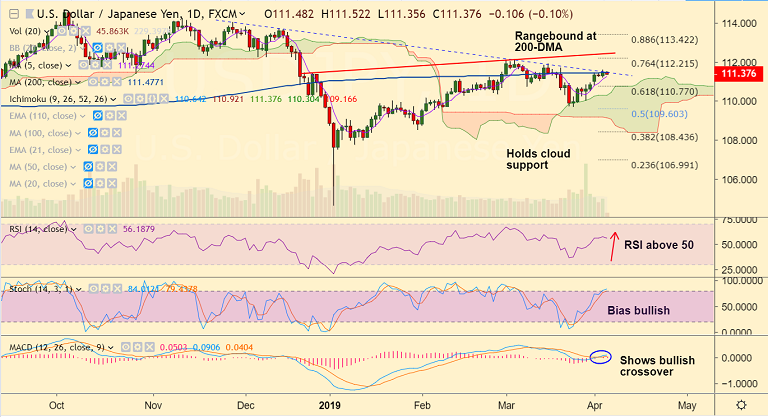

USD/JPY chart - Trading View

- USD/JPY is trading in an extremely tight range in the Asian session today.

- The pair finds stiff resistance at 200-DMA, break above will see further upside.

- Yen largely muted despite positive sentiment and another poor Japanese data released earlier today.

- Japan's service sector activity eased in March, with the Nikkei PMI printing 52.0 from 52.3 in February.

- US Treasury yields advanced to fresh 2-week highs, with the yield on the benchmark 10-year note reaching 2.52% intraday.

- Technical bias remains bullish. Break above 200-DMA to propel the pair higher.

- Next major resistance lies at 76.4% Fib at 112.21 ahead of trendline resistance at 112.45.

- Developments surrounding the US-China trade negotiations will impact price. Focus now on U.S. NFP data for direction.

Support levels - 111.27 (5-DMA), 110.99 (110-EMA), 110.87 (55-EMA)

Resistance levels - 111.47 (200-DMA), 112, 112.21 (76.4% Fib)

Recommendation: Stay long on break above 200-DMA, SL: 110.95, TP: 112/ 112.20

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.