USD/JPY chart - Trading View

* Risk-off mood amid fresh coronavirus jitters dents upside in USD/JPY

* BOJ’s Kuroda struck downbeat tone, Adachi says BoJ stands ready to control interest rates

* US trade tussles with China, the European Union (EU) and the UK keep sentiment sour

Japan’s inflation data flashed mixed results. Tokyo Consumer Price Index arrived at +0.3% YoY in June versus +0.6% expected and +0.4% last. While core CPI matched 0.2% forecast and prior.

Earlier during the day, BOJ Governor Haruhiko Kuroda said that the coronavirus (COVID-19) pandemic has had a severe impact and that Japan’s Q2 GDP could see considerable contraction.

Further, new board member Seiji Adachi that the BoJ stands ready to intervene to avoiding one-sided rises, to prevent collapse in Japan’s finances.

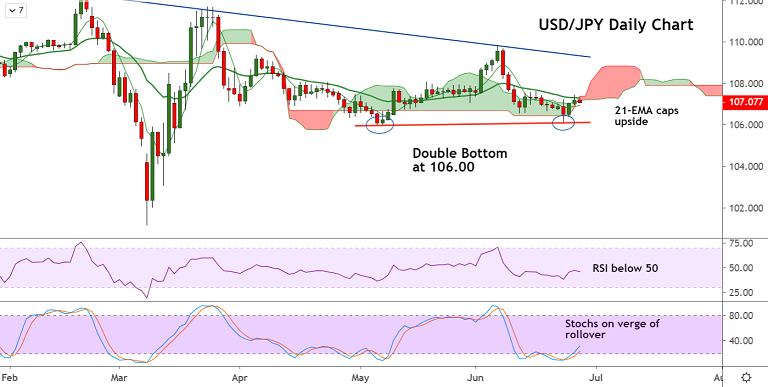

USD/JPY trades rangebound below 21-EMA resistance. Major trend in the pair remains bearish and recovery seems to have faded out at 21-EMA resistance and daily cloud.

5-DMA is holding minor support at 106.94. Break below could see weakness. Traders look for fresh qualitative clues for impetus.

Major Support - 106.00 (Double Bottom); Major Resistance - 107.30 (21-EMA)