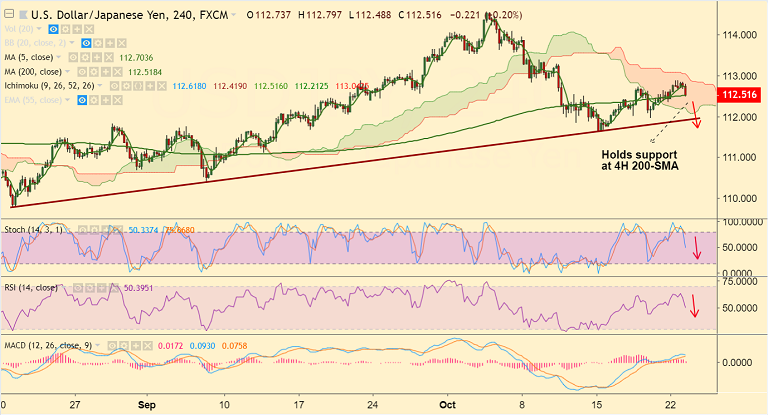

USD/JPY chart on Trading View used for analysis

- USD/JPY trades in the red in the Asian session today as trades remain caution amid rising risk-off.

- Markets continue to be wary about contagion on the EMs and DMs as a result of higher interest rates and defaults.

- The pair has failed below 113 handle and is currently trading 0.23% lower on the day at 112.55 at the time of writing.

- Price action is holding support at 4H 200 SMA at 112.51, break below will see drag till trendline support at 111.95.

- Next major support below 111.95 lies at 110-EMA at 111.42. Bearish resumption likely on break below.

- US Q3 GDP is a big data event due this Friday which will determine further direction for the pair.

Support levels - 112.51 (4H 200 SMA), 112.11 (55-EMA), 111.95 (trendline)

Resistance levels - 112.94 (20-DMA), 113

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.