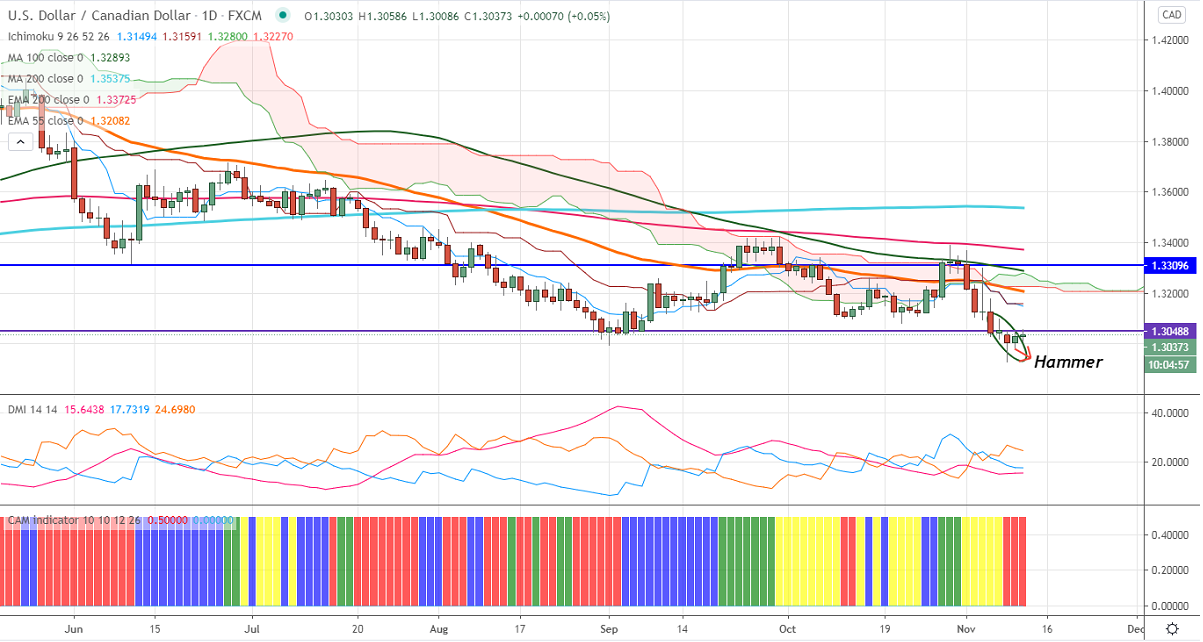

Candlestick pattern- Hammer

Ichimoku analysis (Hourly Chart)

Tenken-Sen- 1.31591

Kijun-Sen- 1.31591

USDCAD has halted it's one –week bearish trend and shown a minor recovery. The surge in the number of coronavirus cases is has increased demand for Safe-haven assets like the US dollar. DXY has shown a minor recovery after hitting a low of 92.18. The short term trend is still bullish as long as support 92 holds. Loonie hits an intraday high of 1.29551 and currently trading around 1.29551.

WTI crude oil recovered more than 25% in November month as global sentiment improves. Short term trend is bullish as long as support $40.50 holds.

Technically, the pair faces near term resistance at 1.3050. Any violation above targets 1.3100/1.31600. The near term support is around 1.2980; an indicative break below will take to the next level till 1.2925/1.2900.

It is good to buy on dips around 1.30325-350 with SL around 1.3000 for the TP of 1.1.3160.