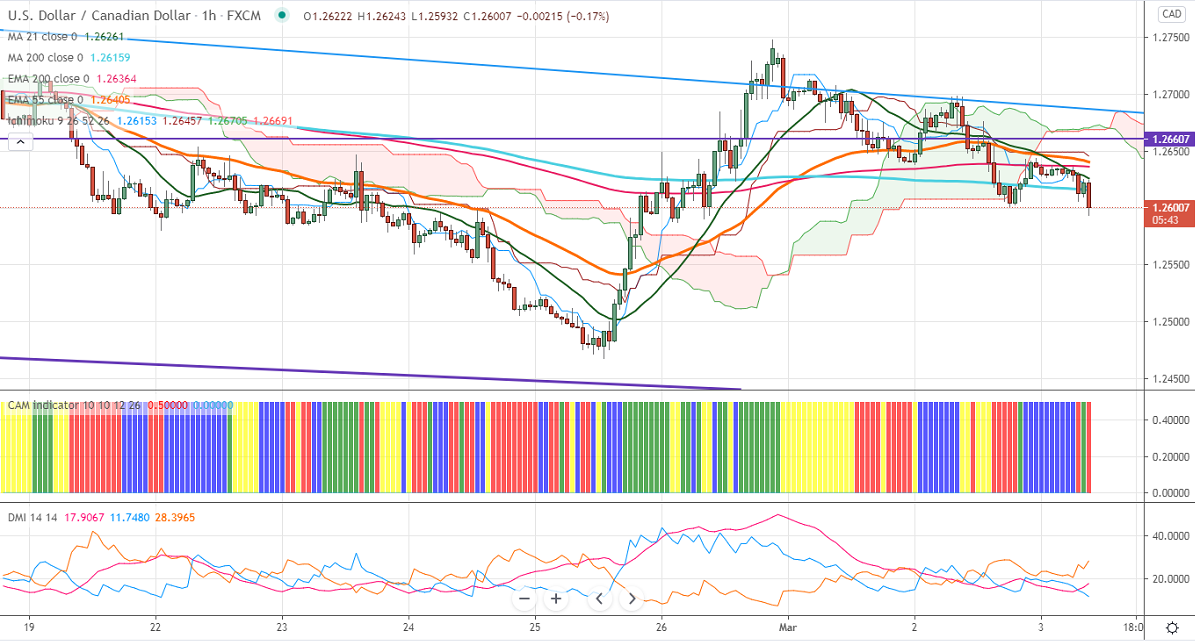

Ichimoku analysis (Hourly Chart)

Tenken-Sen- 1.2622

Kijun-Sen- 1.26492

USDCAD continues to trade weak for third consecutive days and lost more than 150 pips despite the strong US dollar. According to Statistics Canada, GDP rose by 0.5% in Jan compared to 0.1% in Dec. The upbeat market sentiment and surge in crude oil prices are supporting the Canadian dollar. But the surge in US bond yield is preventing form further downside. USDCAD hits an intraday low of 1.25933 and currently trading around 1.25944.

WTI crude oil recovered more than $1.5 after a huge sell-off due to OPEC plans to increase supply. The overall trend is bullish as long as support $59.20 holds.

Technically, the pair faces near-term resistance at 1.2650. Any indicative break above will take till 1.2700/1.2755/1.2800/1.2835. The significant support is around 1.2590; an indicative violation below will take to the 1.2520/1.2480.

Indicator (Hourly chart)

CAM indicator – Bearish

Directional movement index –Bearish

It is good to sell on rallies around 1.2648-50 with SL around 1.2700 for a TP of 1.2525.