The crude oil prices tumbled again on yesterday as a build-up in EIA’s crude inventory check and record Saudi Arabian production weighed on markets.

Oil dropped cuttingly after data from the U.S. Energy Information Administration showed crude inventories rose 1.1 million barrels in the week ended Aug. 5. Analysts polled by Reuters had expected a 1.0 million-barrel crude draw instead.

US crude output continues to decline, but crude and product demand are weakening.

Non-fundamentals: Moderately bearish, Managed money is neutral and technicals are bearish.

Major focus for the day is that EIA’s inventory check, the latest US EIA forecasts show relatively flat US crude output starting in Oct. 2016. The US EIA's July Drilling Productivity Report forecast that total US shale oil production will average 4.55 Mb/d in August, a drop of 99 kb/d vs. July. The rapid decline rate of older wells is starting to ease.

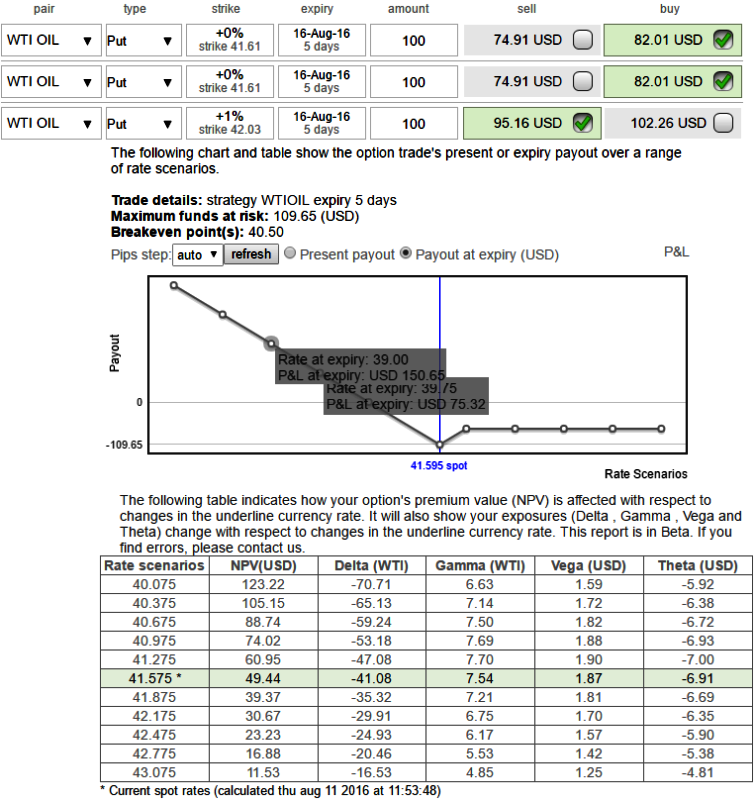

Hence, medium to long term crude oil traders who wish to invest in this commodity are advised to seek cautiously a better entry points (wait for dips) and affix an at the money -0.49 delta put option of equivalent quantities of outrights in underlying commodity, keep an expiry as long as they wish to take physical deliveries.

By adding this extra OTM put option position, while shorting an ITM put with shorter expiry.

The strategy safeguards underlying energy commodity portfolio, thereby any loses would be minimal to the extent of premiums paid to buy ATM options. On short side, maximum loss occurs when the WTI price dives below spot commodity prices at expiration.

The strategy is usually to be employed when investors suspicious about price drops and uncertainties in fundamentals of crude prices.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate