Bank of Thailand (BoT) has kept its interest rate unchanged at 1.5 percent since June 2015. The central bank is more inclined to maintaining loose monetary conditions via a weaker THB rather than lower rates. And with two central bank meetings remaining for this year (in November and December), we see little probability of another cut in 2016.

Thailand's headline inflation was -0.9 percent in 2015 and the nation continues to face disinflationary pressures. Given the modest economic recovery and low oil prices, analysts expect inflation to stay around 0 percent and 0.8 percent in 2016 and 2017 respectively, which is still at the lower end of BoT’s 1-4 percent medium-term target for headline inflation. However, BoT has downplayed the deflationary risks, stating that core inflation is still holding around 1 percent.

After growing by a mere 0.9 percent in 2014 due to political uncertainty, Thailand's economy is expected to expand by a respectable 3.1 percent in 2016 from 2.8 percent in 2015. The domestic sector is likely to be the main driver. However, the buildup in household debt may constrain domestic consumption. That said, government's support to large scale infrastructure projects and continued political stability could help revive investment spending and see a more sustainable recovery.

In H1 2016, the economy grew 3.4 percent and the government is projecting a growth of 3–3.5 percent for the year 2016. Commerzbank currently projects 2017 growth of 3.2 percent.

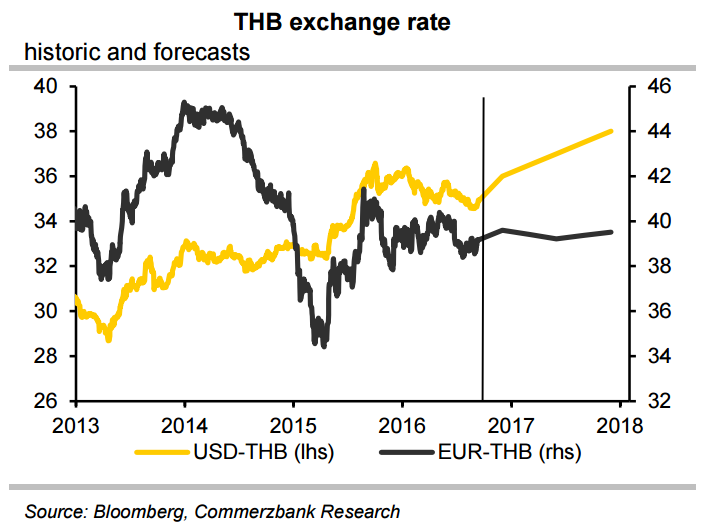

A broadly stronger USD on the back of rising hopes of a Fed rate hike, BoT’s preference for a weaker THB and persistent political uncertainty have weighed on the THB. THB was the third worst performing currency in Asia in 2015 and on account of the above-mentioned reasons is likely to remain on a weakening trend. Commerzbank forecasts USD-THB at 36.00 by end-2016.

USD/THB was 0.73 percent higher on the day. The pair was trading at 35.72 at around 12:00 GMT. Technical indicators suggest further upside. 20-period weekly MA at 34.96 is major support on the downside. Weakness could resume only on break below. On the upside we see next hurdle at 35.80 levels. Break above will see test of 36.67 levels.

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data