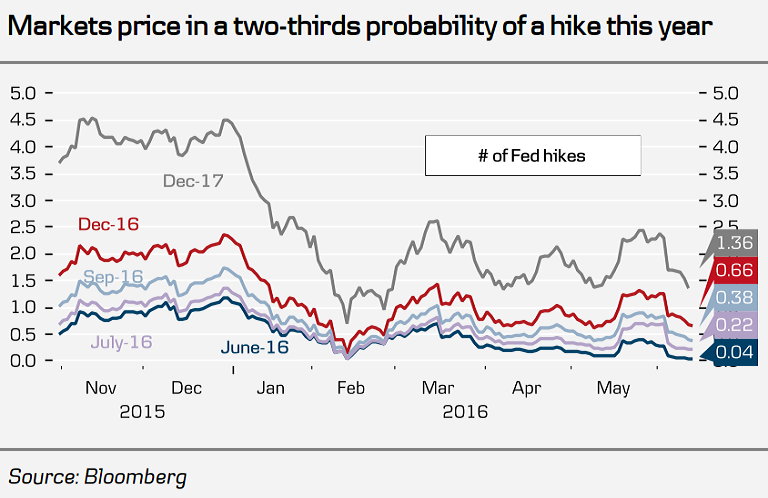

On Tuesday 14th June, the U.S. Federal Open Market Committee begins a two-day meeting. FOMC is expected to maintain the Fed funds target range at 0.25-0.50% when the meeting is concluded on Wednesday. Markets have pushed back expectations on the timing of the next rate hike by the U.S. central bank after a dismal U.S. employment report for May, which showed the slowest rate of jobs growth since September 2010, casting doubts over the health of the U.S. economy.

Focus will be on its communication in the statement through updated economic projections and Fed chair Yellen’s press conference. In her latest speech just before the blackout period ahead of the FOMC meeting, Yellen did not repeat that a hike ‘in coming months’ could be appropriate and she highlighted the downside risks to the US economic outlook. She also mentioned that while the jobs report ‘was, on balance, concerning’ she thinks that ‘one should never attach too much significance to any single monthly report’.

"While some individual ‘dots’ are likely to be lowered, we think the median ‘dots’ for this year and next will be unchanged, signalling two and four hikes, respectively," said Nordea Bank in a report.

One weak jobs report is not enough for the Fed to change its view on the economic outlook significantly, given that other economic data has been strong in Q2. Last year, the September jobs report was pretty weak, but October report came out really strong and the Fed ended up raising rates in December. If we see a rebound in the June jobs report and other data also meets expectations, the Fed could prepare markets for a September hike at the July meeting.

"We believe the Fed will adopt a 'wait and see' approach. We still expect one hike this year and three next year. Our assumption of a September hike is based on our main assumption that the UK remains in the EU. If not, the second hike could be postponed even further." adds Nordea Bank.

The U.S. dollar index, which measures the greenback’s strength against a trade-weighted basket of six major currencies, was steady at 94.47, as investors remained cautious ahead of the Federal Reserve’s monthly policy meeting this week. The FOMC meeting this week is likely to be neutral for EUR/USD which was trading at 1.1272 at 1140 GMT.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand