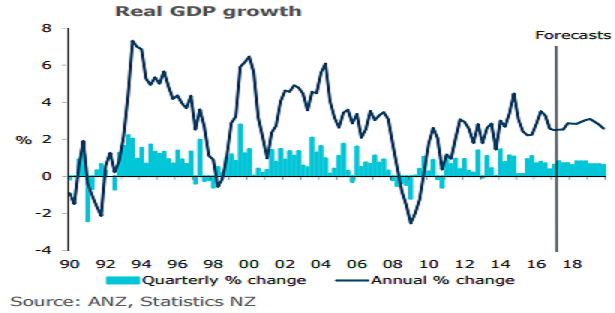

New Zealand’s GDP growth is expected to hold in a 2-1/2 to 3 percent range going forward over the near term. A necessary turn in the housing cycle to curb financial stability risks, weak productivity growth and capacity constraints cap the upside. At the same time, the drivers of the economic expansion are evolving, ANZ Research reported.

However, the economy is grappling with some material growth headwinds, many of them unsurprising given the economy is in its eighth year of expansion. Financial stability considerations have necessitated a turn in some pro-cyclical pockets of the economy.

Further, the combination of LVR restrictions, restrained credit, a turn in the interest rate cycle, stretched affordability and reduced interest from offshore buyers has slowed housing market momentum, especially in Auckland.

Also. The growth in international tourist arrivals is slowing. The sector’s recent performance has been strong, in part due to recent sporting events. However, the rate of underlying growth had starting slowing ahead of this, and we suspect that that reflects capacity issues more than anything.

"We see inflation creeping higher, but only gradually; Non-tradable inflation is forecast to hold around its current 2-1/2 percent level for a while longer, before inching up towards 3 percent by the middle of 2019. Tradable inflation will be thrown around by moves in oil prices and the NZD, but ultimately is expected to average only a little above zero," the report said.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens

Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility