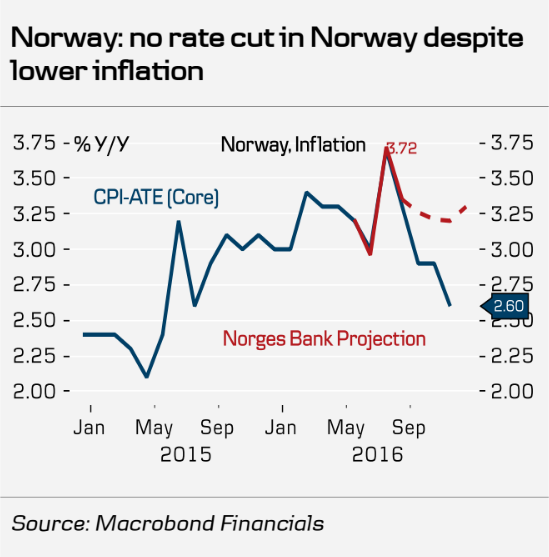

Norway's Norges Bank is scheduled to hold its rate-setting meeting and publish its new monetary policy report on Thursday. At its previous meeting in September, the central bank indicated a roughly 40 percent chance of a further rate cut by June next year. However, subsequent communication by the board was much clearer which suggested the central bank had hit bottom with rates. The message was again repeated at the central bank's October policy meeting.

"Our analysis indicates, on balance, that we are looking at a 10-15bp downward revision of the interest rate path for next year. In isolation, this would mean the new path showing an almost 100% chance of a further rate cut." said Danske Bank in a report.

That said, Norway's housing market seems to have been even stronger than expected, supported by low interest rates. Data released last week showed Norwegian home prices rose 0.8 percent from October to November (seasonally adjusted). The annual growth rate fell marginally, but that was caused by an unusually strong growth in November last year.

There is less need for a cut now as growth is picking up and interest rates seem to have bottomed elsewhere in the world. Meanwhile, the Norges Bank does not want to fire up the housing market further with a rate cut now, although the central bank has previously stressed that other authorities must be the first line of defense to ensure financial stability.

“We do not expect NB to cut further and we think that a dovish rate path along with the usual worsening of the liquidity situation going into end year could lead to some temporary upside support in EUR/NOK – especially after the past couple of days’ decline on the back of the OPEC deal”, said Danske Bank in a report.

EUR/NOK was trading at 4.9490 at around 1200 GMT. Technical studies are bearish. The pair is extending downside as rising oil prices on the back of the OPEC deal support NOK. Next major supports for the pair lie at 8.922 (Oct 19,20 lows) and then 8.90 (Oct 4 low).

FxWirePro's Hourly Currency Strength Index at 1200 GMT showed EUR strength was at -96.4879 (Slightly bullish). For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook