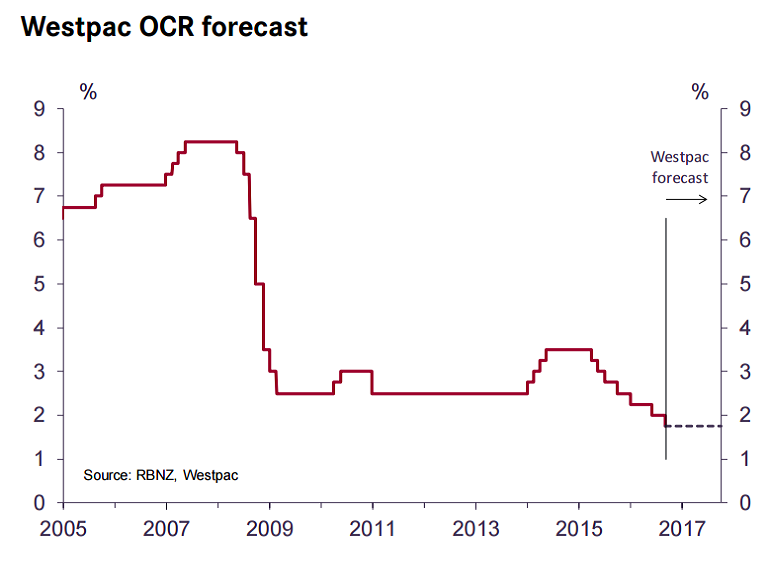

The Reserve Bank of New Zealand at Thursday's Monetary Policy meeting cut the Official Cash Rate to a new record low of 1.75 percent as widely expected and signalled it has probably done enough to return inflation to target as economic growth quickens. Downside risks to the domestic economic outlook have been dissipating and the RBNZ remains conscious of the risks of over-stimulating the economy and housing market, as well as the associated risks for the exchange rate.

The central bank shifted to a more neutral stance amid signs that the New Zealand economy is on increasingly solid footing, with positive signs in the household and business sectors, continued strong population growth, and gains in commodity prices. The Kiwi saw a knee-jerk spike to 0.73 levels initially following the interest-rate cut, but quickly pared gains before falling back to be little changed.

RBNZ Governor Graeme Wheeler said that the central bank remains worried about market instability and U.S. political upheavals, adding that heightened global market volatility in the wake of Donald Trump’s unexpected U.S. election win could trigger further rate cuts.

New Zealand “is not an economy that is crying out for urgent stimulus to boost inflation,” said Nick Tuffley, chief economist at ASB Bank Ltd. in Auckland. “From here we continue to expect the RBNZ will remain on hold, which is the RBNZ’s current stance.”

On the technical charts, 'Bearish Bat' pattern formed on NZD/USD dailies. We see scope for downside in the pair. 5-DMA is biased lower, along with Stochs and RSI. Strong support is seen at 0.7214 (20-DMA). Violation there could see further downside. NZD/USD was trading at 0.7222 at around 12:45 GMT.

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens

Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens