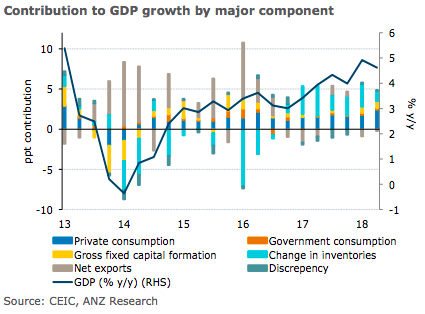

Thailand’s gross domestic product (GDP) for the second quarter of this year cheered market participants; at 4.6 percent y/y (1 percent q/q sa), Q2 2018 GDP growth came in only marginally short of ANZ Research’s estimate.

The Q1 2018 number was also revised upward to 4.9 percent y/y (2.1 percent q/q sa) from 4.8 percent y/y previously. The breadth of growth remains impressive, with private consumption, investment, and exports improving over their performance in the previous quarter.

Similar to the previous quarter, the breadth of growth remains impressive. Private consumption increased by 4.5 percent y/y, the strongest pace since Q1 2013. Investment and exports also strengthened to 3.6 percent y/y and 6.4 percent y/y respectively, from 3.4 percent and 6.0 percent respectively in the previous quarter. Government consumption slowed marginally.

Within overall investment, private activity increased by 3.2 percent y/y, slightly faster than in the previous quarter. The on-going improvement in private investment reflects a combination of improving capacity utilisation and a ‘crowding in’ of the private sector by public infrastructure spending. Public investment increased by 4.9 percent y/y, again an improvement over the 4 percent y/y growth recorded in Q1.

"The H1 2018 GDP outturn of 4.8 percent y/y is impressive. Viewed in conjunction with the fact that inflation has now settled in the BoT’s target range of 1-4 percent, the conditions for policy normalisation are falling in place. We continue to expect a 25 basis points increase in November 2018," ANZ Research commented in its latest report.

Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality