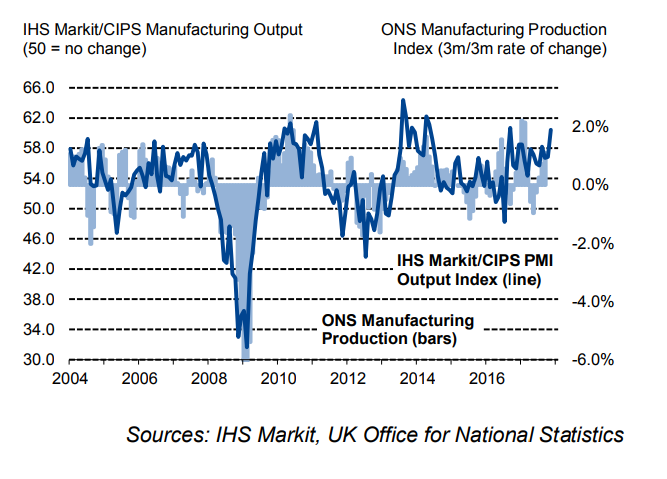

Data released earlier today by financial information firm IHS Markit Ltd showed that UK purchasing managers index for the manufacturing industry, jumped to 58.2 in November, up from the upward-revised reading of 56.6 a month earlier. Positive turnaround in global growth, which along with the weaker pound, has seen manufacturing sentiment soar in the UK.

November's figure was the highest in 51 months and came significantly above the economists' expectations as new orders jumped. The expansion remained broad-based by subsector. Backlogs of work at UK factories increased for the first time in six months during November. Manufacturers maintained a positive outlook for the sector in November, with over 50 percent expecting production to be higher in one year’s time.

"The manufacturing sector is a clear bright spot in the UK economy at the moment, but the larger service sector is still flagging and is why they don't expect a sharp pick-up in growth next year," said James Smith, Economist at ING.

On the price front, rates of inflation in input costs and output charges remained elevated. November saw purchasing costs rise at a pace close to October’s seven-month high. Output charges continued to rise at a substantial clip, the fastest for seven months and among the highest during the past six-and-a-half years. The impact of recent interest rate rise by the Bank of England on reining in cost pressures will be evident in the coming months.

"The outlook for interest rates also relies heavily on Brexit negotiations. We still think the Bank will keep rates on hold in 2018, although admittedly this is an increasingly close call. Policymakers have signaled they would be comfortable with a hike next year and a move in February or May therefore certainly shouldn't be ruled out.” adds ING in a report.

Cable edges higher from session lows at 1.3475 and retakes 1.35 handle post upbeat PMI data. GBP/USD has been in rising trend since beginning of November. Positive headlines and renewed optimism around the Brexit negotiations combined with the persistent weakness surrounding the greenback supporting the pair higher. 5-DMA at 1.3418 is immediate support, while 88.6 % Fib retrace of 1.3657 to 1.3027 fall at 1.3588 is resistance.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate