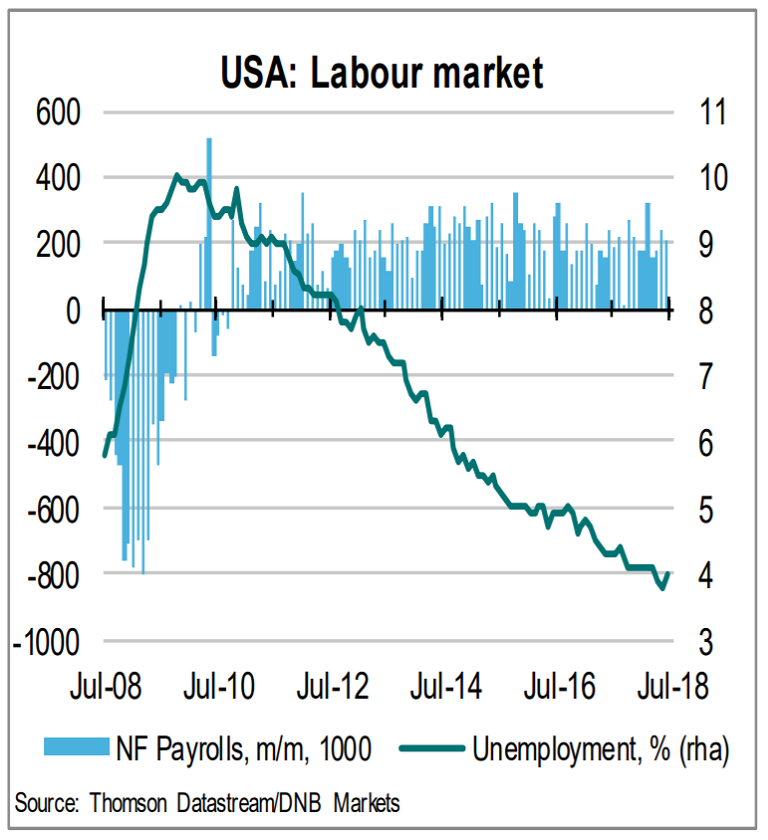

Data released by the Labor Department on Friday showed the U.S. economy created more jobs than expected in June, a second straight month of solid gains. Nonfarm payrolls advanced by 213,000 jobs last month, the Labor Department said. Data for April and May was revised to show 37,000 more jobs created than previously reported.

The unemployment rate, however rose to 4 percent from an 18-year low of 3.8 percent in May, as more people returned to the job market. The more closely-watched inflation gauge — wage growth — rose less than forecast. Average hourly earnings rose 5 US cents, or 0.2 percent, in June after increasing 0.3 percent in May. Another solid month of job gains provided little help to wages. Average hourly earnings rose 2.7 percent year over year, a bit below expectations of a 2.8 percent increase.

"The fact that wage growth isn't stronger remains a bit of a puzzle. But we take consolation that other measures of wage gains that aren't affected by demographics or industry mix show healthier gains for workers," said TD Economics in a report.

The Federal Reserve has increased its benchmark interest rate twice this year and has indicated two more hikes before the end of 2018. The FOMC minutes released last Thursday has indicated policymakers' concern about the jobs market and Friday's employment report confirmed that the wage pressures remain subdued.

"Overall the labour market still seems solid and points at more rate hikes later this year. We expect the Fed to hike again later in September and in December," said DNB Markets in a report to clients.

USD/JPY closed weaker on Friday as the dollar weakened after the employment data. The Dollar on the soft side in today's trade as US-China tariffs kick in. USD/JPY was trading at 110.45, while EUR/USD was trading at 1.1769 at 0945 GMT. The dollar index DXY was extending weakness for the 3rd straight session, down 0.15 percent at 93.83 at the time of writing. DXY finds strong support at 55-EMA at 93.56. Break below will accentuate weakness.

FxWirePro's Hourly USD Spot Index was at -32.9275 (Neutral) at 0745 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

U.S. non-farm payrolls post second straight month of solid gains, warrant for more rate hikes this year

Monday, July 9, 2018 11:37 AM UTC

Editor's Picks

- Market Data

Most Popular

9

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient