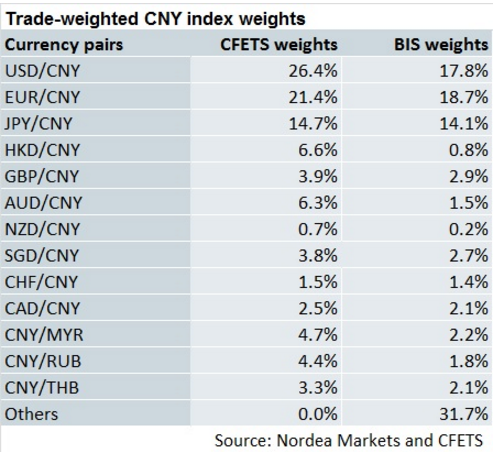

The central bank of China announced a new currency index last Friday, referred to CFETS RMB Index. The CFETS RMB Index is mainly a trade-weighted exchange rate of the CNY, which is measured against a basket of 13 currencies those are traded directly on China Foreign Exchange Trade System (CFETS).

"All in all, the new CFETS RMB Index does not change our view of more gradual CNY weakening on the cards. We continued to forecast USD/CNY at 6.60 at the year-end 2016", states Nordea Bank in a research note.

China has already de-pegged the CNY from the USD in 2005, though in practice, it was following closely the movements of the USD. Analysts see the new trade-weighted exchange rate index as a further de-peg of the CNY from the USD. Allowing the CNY to be driven by trade-weighted basket instead of the USD will indicate liberalization and matureness of the currency, added Nordea Bank.

USD/CNY to trade at 6.60 by end-2016 despite further de-peg

Monday, December 14, 2015 7:25 AM UTC

Editor's Picks

- Market Data

Most Popular