The debate about the cost and benefits of low rates has started heating up. Central bankers like Mario Draghi, Janet Yellen speak in favor of low rates arguing that they have brought stability and without them, the world economy would have been in worse shape than today. The opponents argue that the central banks’ monetary policies have created asset bubbles. US Presidential candidate Donald Trump said they created a false and bubbly economy, former chancellor of exchequer UK George Osborne say that these policies make the rich even richer.

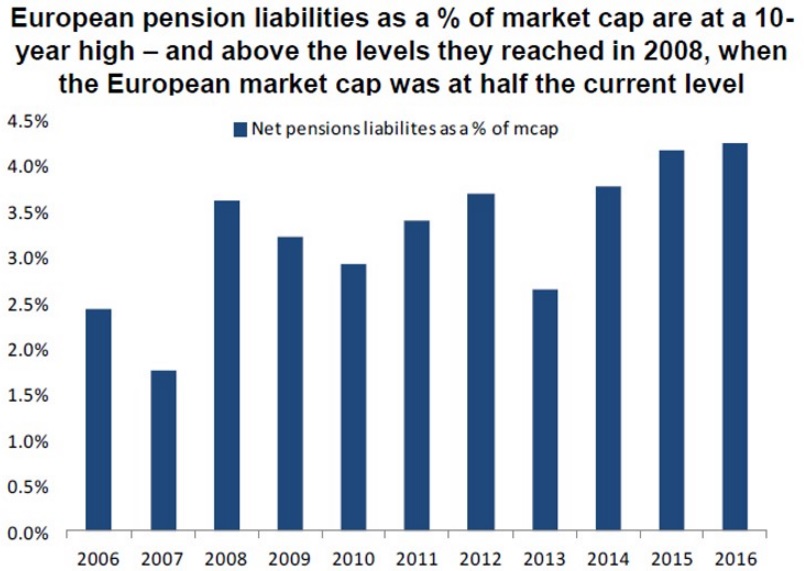

However, there are some worrying signs that even central bankers can’t refute and they are the children of easy monetary policies. The first chart from the Deutsche bank shows, the lower interest rates that have pushed down the global yields have resulted in an increase in the pension liabilities. Even if they cash in on the capital gains there few safe options to reinvest. The chart shows that European pension liabilities as a percentage of market cap has hit the highest level in 10 years, bigger than that seen during 2008 crisis.

The second chart shows the low rates have hurt banks’ profitability. European banks’ profitability has seen a steady drop around, in line with the drop in yields. So, Mr. Draghi’s argument that the current negative rates do not hurt banks, may not be entirely true.

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell