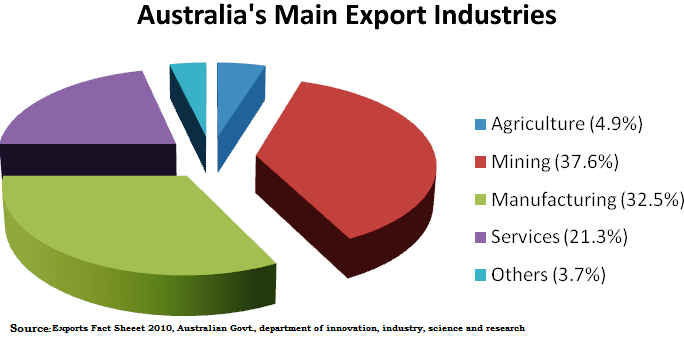

Even though Australian economy is dominated by service sectors, accounts more than 65% of GDP, in the 12 months to 30 June 2015 the value of Australian exports rose by 5% to AU$1.89 billion. The distribution of exports is shown in the diagrammatic representation. But Exports in the region decreased to 25528 AUD million in May of 2015 from 25659 AUD million in April of 2015 as reported by Australian bureau of statistics.

Top brass exporting segments of Australia:

Iron ore (22%), Coal briquettes (18%), Petroleum gas (5.5%), Gold (5.4%), and Crude petroleum (4.5%).

In the 12 months to 30 June 2015, the value of Australian wine exports rose 5 per cent to A$1.89 billion according to the Wine Export Approval Report June 2015 released today by Wine Australia.

UK and Europe:

Europe accounts for a 3rd of Australian wine exports by value and more than half by volume. While exports to the region are on the rise (up 5% to 374 million litres), value declined 1% to A$584 million.

The UK remains Australia's largest export destination by volume remaining steady at 251 million litres however value dropped by 2% to A$369 million. The drop in value can be attributed to the 10% decline in the average value of bulk wine exports to A$0.99/litre.

Exports to Germany increased in value by 6% to A$50 million and in volume by 15% to 39 million litres. This growth was offset however by a decline in average value, with the average value of bulk wine exports falling 10% to A$0.84/litre and bottled exports falling 15 per cent to A$3.58/litre.

Australia's top five export countries by value were reasonably declined; we perceive this as currency deterioration has been one among the reasons:

US - down 7.9% to A$415 million

UK - down 1.5% to A$369 million

China - up 32.1% to A$280 million

Canada - down 0.7% to A$182 million

Hong Kong - up 28.4% to A$112 million.

So, the above descriptions and statistics shows the exporters have been stuck in a riddle somewhere even though it has shown strength in last 12 months. We think that this could be because of adverse impact of their currency depreciation.

A glimpse on Australian exporting business

Friday, July 17, 2015 8:01 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings