ADP employment data to be released at 13:15 GMT is today’s most vital dockets from the US to be watched by market participants. This report is one of the key data that investors will use to gauge US economic strength.

What is ADP employment?

- The report is a measure of non-farm private sector employment which is obtained by utilizing an anonymous subset of roughly 400,000 U.S. businesses which are clients of ADP.

- This data is a very good measure of employment strength of the economy and a good precursor of Nonfarm payroll data.

Previous performance –

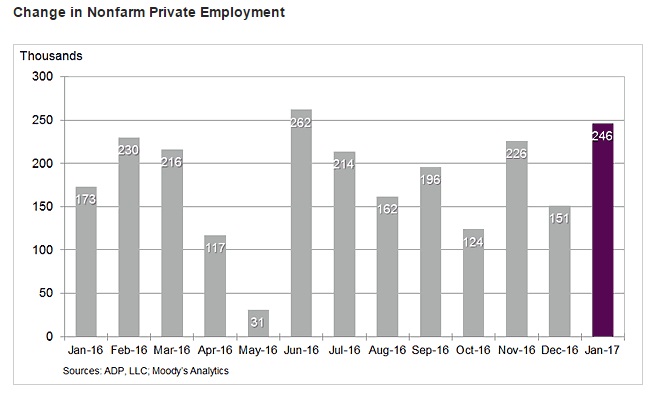

- Non-farm private sector employment grew at 246,000 in January. In December payroll grew by 151,000.

- Small business sector hiring at 62,000.

- Employment in franchise increased by 15,500.

- 15,000 jobs added in the manufacturing sector.

- 46,000 jobs were added in the goods-producing sector.

- Construction sector added 25,000 jobs.

- No jobs were added in financial activities.

- Services sector remains the major job provider. Payroll added 201,000 people in December.

Expectation Today –

- The headline number is expected to decline to 190,000 as per median estimate.

Market Impact –

- Any gain above 200,000 will be considered to be very good and rate hike bets are likely to increase, providing more support to the already rising dollar.

- Data below 150,000 likely to give rise to concerns regarding US economic prowess and investors would have to consider their rate hike outlook.

However, since several FOMC members indicated the willingness to hike in March, a weaker jobs report is likely to weigh more on the equities than on the dollar. The dollar index is currently trading at 101.91, up 0.10 percent so far today.

U.S. Stock Futures Edge Higher as Tech Rout Deepens on AI Concerns and Earnings

U.S. Stock Futures Edge Higher as Tech Rout Deepens on AI Concerns and Earnings  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran