As of now, WTI is up 89% from its February low and still continuing. It is currently trading at $49.1 /barrel, looking to challenge $50 psychological resistance.

Key factors at play in Crude market –

- Canada is trying to restart production as Wildfire has led to shut down of 1.8 million barrels/day production in Alberta, Canada.

- Severe outages in Nigeria, Libya and production halt in Venezuela has taken out another 1.5 million barrels/day supply.

- U.S. oil production has dropped to 8.8 million barrels/day and likely to drop further.

- Major supply increase is taking place from Middle East. Iran boosted exports by 600,000 barrels/day. Saudi Arabia is expected to increase production to 11 million barrels/day.

- Saudi Prince Mohammad bin Salman, who is Kingdom’s new strongman has laid out a plan to diversify Saudi Arabia from oil. Plan is named Saudi Vision 2030. It will increase non-oil revenue to Real 1 trillion by 2030 from current 163 billion.

- India has emerged as biggest incremental crude buyer this year.

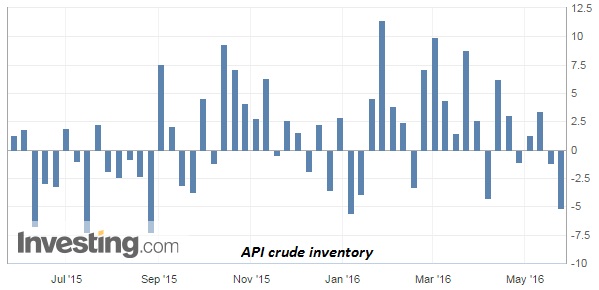

- American Petroleum Institute’s (API) weekly report showed inventory decline by 5.14 million barrels, which is biggest since February and second highest this year.

Today’s inventory report from US Energy Information Administration (EIA), to be released at 14:30 GMT.

Chart courtesy investing.com

Trade idea –

- We expect current rally to increase further, however oil price is likely to low over much longer horizon. Recent offshore pile up around Singapore, known as Singapore glut points to this direction.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX