Crude oil (WTI) is finding support around $43.3/barrel critical support area, however sellers remain at large as market awaits report from EIA. A break below could lead is moving sharply lower ahead of FOMC meeting next week.

However, bears are likely to exercise caution ahead of EIA weekly report.

Key factors at play in Crude market

- Crude oil production in US has dropped but remains above 9 million barrels/day.

- OPEC production is well above 30 million barrels/day quota, highest since 2008. However OPEC members lack further spare capacity to push production higher, without significant investments.

- Iran has additional capacity and might boost production if sanctions removed.

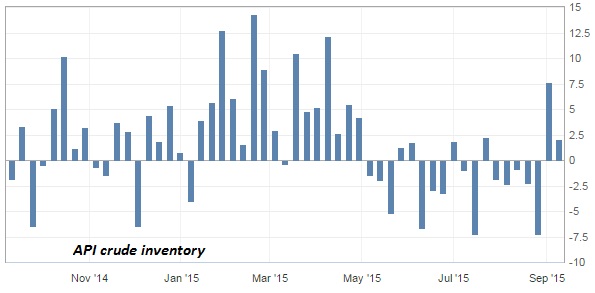

- American Petroleum Institute's (API) weekly report showed inventory surplus of 2.1 million barrels, which is second consecutive weekly rise.

Today's report might work as key catalyst for crude oil market, as volatility is quite high.

Today's inventory report from US Energy Information Administration (EIA), to be released at 15:00 GMT.

Trade idea

- Our short term long call to the upside has soured after reaching around $50, which was given around $45/barrel area, targeting $53/barrel area. Though our stop loss is still quite far away around $40-38/barrel area, we feel opportunity is now greater and attractive lining with fundamental and going short.

- Sell crude small position now, increase short position with break below $43/barrel area and sell at subsequent rallies targeting $34/barrel area with stop around $50/barrel area.