WTI's last week rally got halted around $34.7/barrel and price again declined below $30/barrel to trade as low as $29.4/barrel. WTI is currently trading at $30.2/barrel.

Key factors at play in Crude market

- OPEC remains so divided due to rivalry between Iran and Saudi Arabia, which they couldn't agree to even a joint meeting. Saudi Arabia has pointed out that oil declines, every time OPEC meets and no decision comes out.

- US lawmakers passed bill to lift 40 year oil ban on US crude export.

- Russia's Rosneft played down any chance of a production cut, despite second largest producer LukOil indicating production.

- US oil production has remained quite resilient, despite drop in oil price. US is still producing oil at levels seen during 2014.

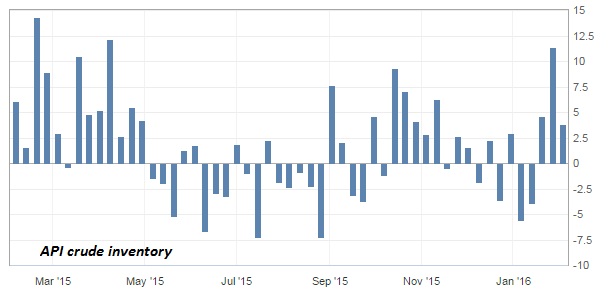

- American Petroleum Institute's (API) weekly report showed inventory rose by 3.84 million barrels.

- Oil price is down, however lack of investments in the sector make prices vulnerable to supply shocks in future.

Today's inventory report from US Energy Information Administration (EIA), to be released at 15:30 GMT.

Trade idea

- We at FxWirePro remains committed to downside, price action suggests further drop in prices. Goldman Sachs has called for $20/barrel oil, while Standard Charted called for $10/barrel and EIA, $5/barrel.

- According to our calculations, next targets for oil are $22 and $20.3/barrel. However if oil finds support around here, correction might reach as high as $40-42/barrel.

- WTI-Brent spread could widen over lower demand of US crude. It is currently at $2.9/barrel.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed