The AUD/JPY declined slightly after weak Australian jobs data.It reached a low of 97.56 and is currently trading around 97.62. The intraday trend remains bullish as long as support at 97 holds.

In August 2025, Australia’s labor market unexpectedly lost 5,400 jobs, driven by a steep decline of 41,000 full-time positions despite a rise of 36,000 part-time jobs, reversing July's gains of 26,500. While the unemployment rate held steady at 4.2%, this was due to a decline in labor force participation to 66.8% as more people exited the workforce. Women were disproportionately impacted, losing 30,000 full-time jobs compared to 11,000 for men, with the shift to part-time roles reflected in a 0.4% drop in monthly hours worked. The underemployment rate improved slightly to 5.7%, its lowest in over a year. The weaker data reinforces the Reserve Bank of Australia’s cautious stance, with markets pricing only a 28% chance of a rate cut in September, while the Australian dollar weakened 0.23% to 0.6636 against the US dollar.

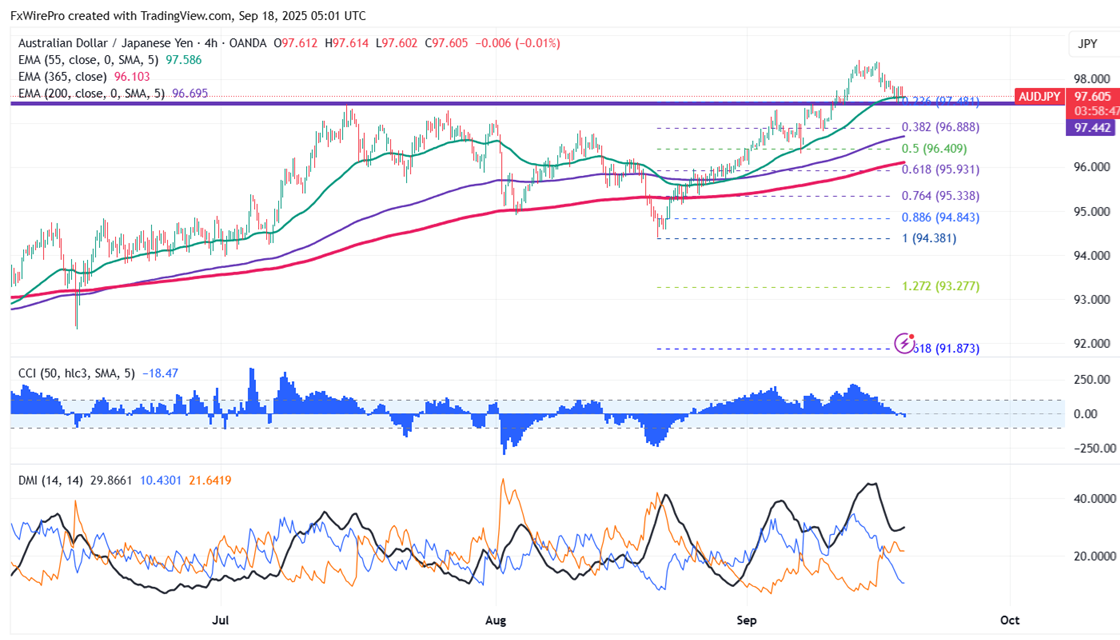

The pair is trading above 55 and 200 EMA and 365 EMA (long-term) on the 4-hour chart, confirming a bullish trend. Any violation below 97.40 indicates the intraday trend is weak. A dip to 97/96.75/96.30/96/ 95.50/95/94.40/93.95/93 is possible. Immediate resistance is at 98, a breach above this level targets 98.50/98.75/100/100.42.

Market Indicators (4-hour chart)

CCI (50)- Neutral

Directional movement index - Bearish

Trading Strategy: Buy

It is good to buy on dips around 97.40-45 with SL around 97 for a TP of 100