AUD/NZD has been one of the more difficult relative value trades in FX markets over the last 6 months; rejecting a break of parity, rallying to 1.14 and then confounding most with a rapid decline back towards 1.05 at the beginning of 4Q15. Over the next year, the forecasts look for a modest rise in AUD/NZD, and it is believed that a move back towards 1.15 looks likely by mid 2016.

From a markets perspective, the key question is whether there is enough in the macro-economic story to justify long positions in the AUD/NZD cross. Economists expect the New Zealand economy to slow quite markedly in the first half of 2016, with 2Q16 growth marked at just 0.7% (q/q saar). In contrast, Australian GDP should track around the low 2s into 2H16 (broadly unchanged from current levels). New Zealand growth out-performance has stalled more because New Zealand growth is slowing, rather than because there has been a discernable uplift in Australian GDP growth. This dynamic should keep the cross in a 1.05-1.15 range for the first half of next year.

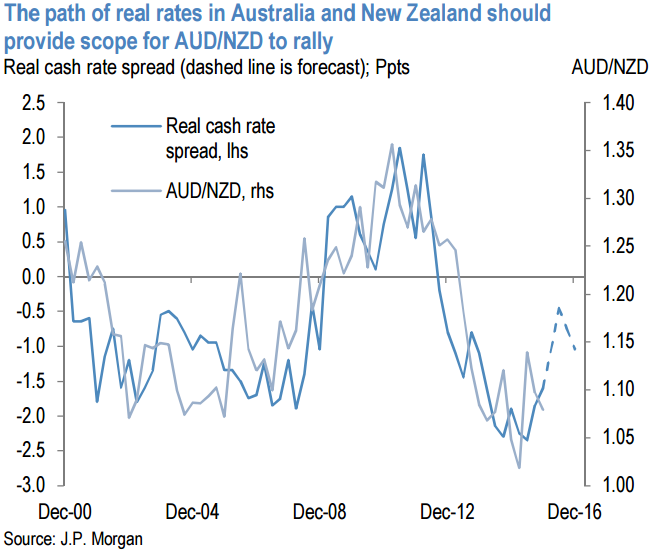

The policy rate spread is expected to compress a further 50bp by 1Q16. This is not really priced in currency markets (relative to the expectation in rates markets). Moreover, real cash rate differentials also suggest that AUD/NZD has troughed for the cycle, and should be biased higher in 1H16. And while the forecasts for Antipodean real cash rates suggest that real rate differentials should continue to support AUD/NZD through 2016, the expected path for short rates is also consistent with the idea that it will be difficult for the cross to make a sustained break to the upside (1.20 or higher).

AUD/NZD should continue its slow grind higher in 2016

Thursday, November 26, 2015 11:48 PM UTC

Editor's Picks

- Market Data

Most Popular