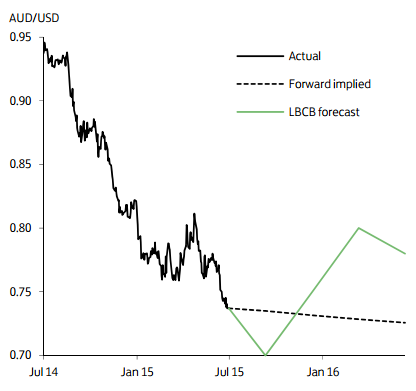

AUD/USD has resumed its descent in recent weeks, hitting a new 6-year low of 0.7350 in mid-July. The fall has coincided with rising concerns over China and weak commodity prices. Over the past month, crude oil has dropped back below $60p/b, while copper has fallen over 9% to a new low. Weakening domestic growth prospects and loose monetary policy have added to the downside.

The RBA left its policy rate unchanged at a record low of 2% in July. Governor Stevens again stressed that the AUD should weaken further (although in a departure from the previous month, he refrained from giving the market numeric guidance). Looking ahead, very strong technical support should hold in the 0.72-0.70 region. But the risks are asymmetric: a break below this level would open the way for another sharp drop.

"The fortunes of the AUD are likely hinge on whether the improvement in western growth compensates for a slowdown in Asia over the medium term. We believe it will. We project AUD/USD will test 0.70 by end Q3, but to recover steadily thereafter," says Lloyds Bank.

AUD/USD Outlook

Monday, July 20, 2015 9:18 PM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX