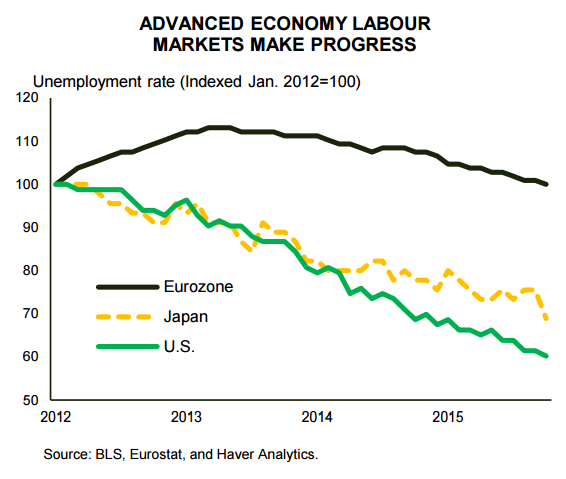

The tepid expansion among EMs is unlikely to stymie growth within advanced nations, where domestic spending has accelerated noticeably. U.S. domestic demand growth has been hovering at 3% for more than a year, reinforcing the notion that the economic drivers are mainly focused inward for America at this point in the cycle. The sizeable appreciation in the greenback is expected to continue to dampen exports, but the broader economic foundation is strong enough to support a modest degree of rate hikes.

The beleaguered euro zone did manage to outperform the growth expectations. Surprisingly perhaps, in a year that featured fears of a "Grexit." However, unlike the U.S., the European Central Bank (ECB) is still stepping on the stimulus-accelerator to lift domestic demand through a combination of quantitative easing and negative interest rates. Private sector lending has been responding and unemployment rates are falling through most of Europe. Both of these positive trends should help to underpin continued gains in domestic demand going forward. The euro area should benefit from a slight tick-up in growth to 1.7% in 2016, a testament that the region has come a long way from the dismal 2014 performance that was roughly half this pace. However, the outlook remains heavily dependent on a central bank that is unlikely to lift its foot off the monetary accelerator.

Past stimulus initiatives in Japan are also starting to bear fruit. After a 0.7% increase this year, Japan is forecast to grow at a faster 1.2% pace in 2016. That may sound slow, but it is fairly good for an economy whose working age population is falling by 1.5% each year. That reality makes Japan's recent solid employment growth more impressive, as it comes from rising labor force participation.

As a large energy importer, Japan has also enjoyed a big boost to its purchasing power due to lower oil prices. All of these forces should help sustain the domestic economy in the face of softer EM demand, although a planned sales tax hike in 2017 is expected to crimp overall GDP growth in that year.

Advanced economies continue to make progress

Thursday, December 17, 2015 11:50 PM UTC

Editor's Picks

- Market Data

Most Popular

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Asian Markets Slip as AI Spending Fears Shake Tech, Wall Street Futures Rebound

Asian Markets Slip as AI Spending Fears Shake Tech, Wall Street Futures Rebound  Australia’s December Trade Surplus Expands but Falls Short of Expectations

Australia’s December Trade Surplus Expands but Falls Short of Expectations  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears

Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears  U.S. Stock Futures Edge Higher as Tech Rout Deepens on AI Concerns and Earnings

U.S. Stock Futures Edge Higher as Tech Rout Deepens on AI Concerns and Earnings