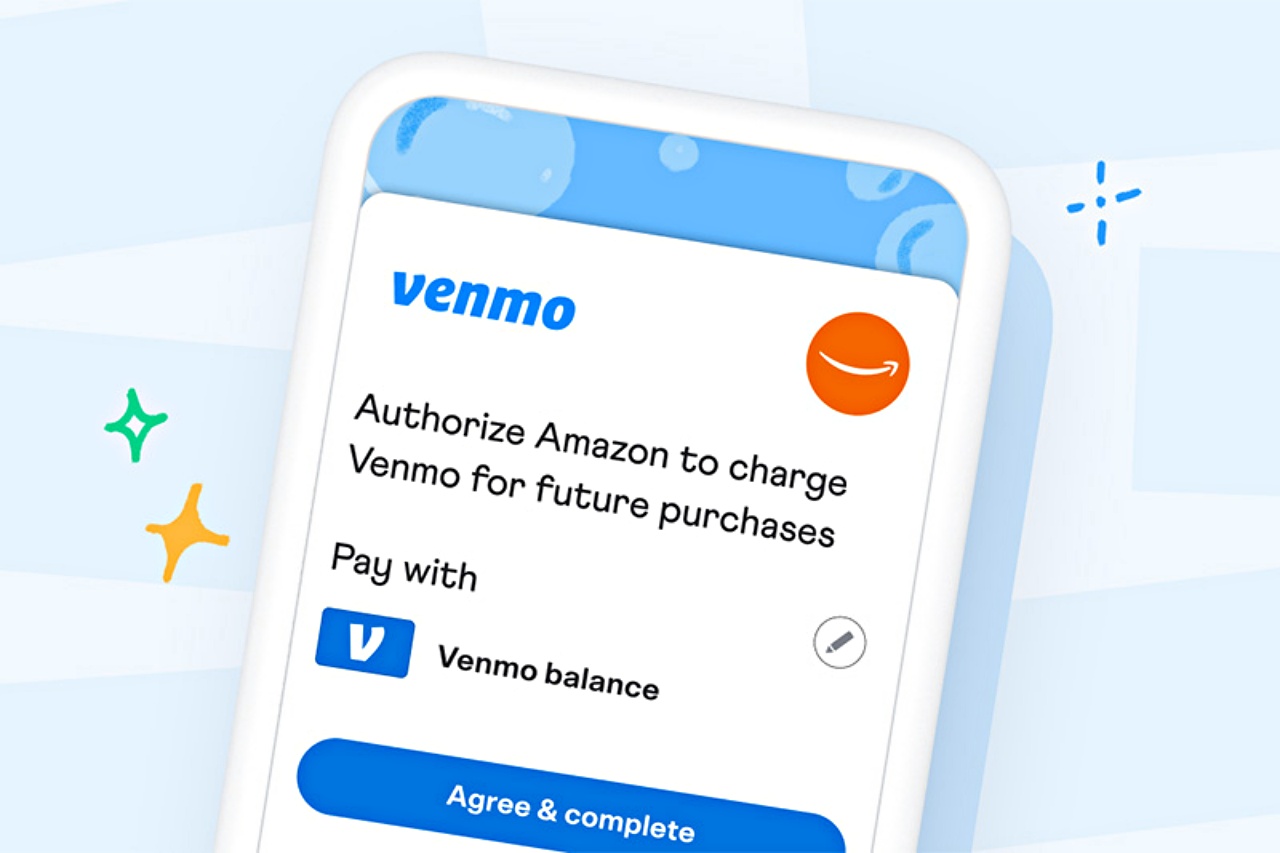

Amazon introduces a new payment option for its customers and said that starting Tuesday, Oct. 25, they can pay with Venmo upon checkout for their purchases. However, only select customers will see the option since it is still in the initial stage.

The checkout using Venmo as the payment option will be available in both online and mobile app set-up. This can be used instead of credit cards, and Amazon said that customers in the United States would be able to use the service by Black Friday, the busiest shopping day of the year, which falls on Nov. 25 this year.

As per CNN Business, users must add Venmo as one of the payment methods in their Amazon account. At the checkout, customers may simply check it as the option they prefer when paying.

The addition of this new payment is said to be part of the e-commerce giant’s plan to expand its checkout payment methods so customers will have more choices and pick the one that suits them the best. This is the latest new feature after Amazon included the buy now, pay later scheme for purchases worth more than $50. The company teamed up with Affirm for this BNPL offer last year.

“Starting to roll out to select Amazon customers today, Venmo will be available to United States customers by Black Friday,” Paypal stated in a press release. “The option to pay with Venmo on Amazon brings the familiarity and trust you know and love about using Venmo to the Amazon shopping experience.”

The company went on to say, “Whether it’s restocking household essentials or purchasing a last-minute gift, we know that Venmo users shop over two times more frequently than the average shopper and are 19% more likely to make repeat purchases1, which makes paying with Venmo the perfect fit for the avid Amazon shopper.”

Meanwhile, shares of Paypal, which owns Venmo, was said to have soared by seven percent on Tuesday after the announcement of its team-up with Amazon, and this may be an indication of a positive response from the public.

Hyundai Motor Group to Invest $6.26 Billion in AI Data Center, Robotics and Renewable Energy Projects in South Korea

Hyundai Motor Group to Invest $6.26 Billion in AI Data Center, Robotics and Renewable Energy Projects in South Korea  Lynas Rare Earths Shares Surge on Strong Half-Year Earnings and Rising Global Demand

Lynas Rare Earths Shares Surge on Strong Half-Year Earnings and Rising Global Demand  Flare, Xaman Roll Out One-Click DeFi Vault for XRP Yield via XRPL Wallets

Flare, Xaman Roll Out One-Click DeFi Vault for XRP Yield via XRPL Wallets  Germany and China Reaffirm Open Trade and Strategic Partnership in Landmark Beijing Visit

Germany and China Reaffirm Open Trade and Strategic Partnership in Landmark Beijing Visit  OpenAI Hires Former Meta and Apple AI Leader Ruomin Pang Amid Intensifying AI Talent War

OpenAI Hires Former Meta and Apple AI Leader Ruomin Pang Amid Intensifying AI Talent War  MOEX Russia Index Hits 3-Month High as Energy Stocks Lead Gains

MOEX Russia Index Hits 3-Month High as Energy Stocks Lead Gains  Oil Prices Steady as US-Iran Nuclear Talks and Rising Crude Inventories Shape Market Outlook

Oil Prices Steady as US-Iran Nuclear Talks and Rising Crude Inventories Shape Market Outlook  Anthropic Refuses Pentagon Request to Remove AI Safeguards Amid Defense Contract Dispute

Anthropic Refuses Pentagon Request to Remove AI Safeguards Amid Defense Contract Dispute  Trump Touts Stock Market Gains and 401(k) Boost Amid Tariff Uncertainty

Trump Touts Stock Market Gains and 401(k) Boost Amid Tariff Uncertainty  FCC Approves Charter Communications’ $34.5 Billion Acquisition of Cox Communications

FCC Approves Charter Communications’ $34.5 Billion Acquisition of Cox Communications  Snowflake Forecasts Strong Fiscal 2027 Revenue Growth as Enterprise AI Demand Surges

Snowflake Forecasts Strong Fiscal 2027 Revenue Growth as Enterprise AI Demand Surges  Pentagon Weighs Supply Chain Risk Designation for Anthropic Over Claude AI Use

Pentagon Weighs Supply Chain Risk Designation for Anthropic Over Claude AI Use  OpenAI Pentagon AI Contract Adds Safeguards Amid Anthropic Dispute

OpenAI Pentagon AI Contract Adds Safeguards Amid Anthropic Dispute  Samsung Electronics Stock Poised for $1 Trillion Valuation Amid AI and Memory Boom

Samsung Electronics Stock Poised for $1 Trillion Valuation Amid AI and Memory Boom  Meta Signs Multi-Billion Dollar AI Chip Deal With Google to Power Next-Gen AI Models

Meta Signs Multi-Billion Dollar AI Chip Deal With Google to Power Next-Gen AI Models  FAA Plans Flight Reductions at Chicago O’Hare as Airlines Ramp Up Summer Schedules

FAA Plans Flight Reductions at Chicago O’Hare as Airlines Ramp Up Summer Schedules  BOJ Signals Possible April Rate Hike as Ueda Eyes Inflation and Wage Growth Data

BOJ Signals Possible April Rate Hike as Ueda Eyes Inflation and Wage Growth Data